Approximately 900,000 international students currently study in Canada. Studying abroad brings excitement, but knowing how to save money as an international student can be tough with yearly tuition fees ranging from $7,000 to $22,000.

The bright side is that international students can earn $20,000 to $30,000 each year. This comes from part-time work and full-time employment during breaks. Students who share living spaces with roommates save thousands of dollars yearly on rent and utilities.

The 50/30/20 rule makes budgeting substantially easier. Students should put 50% of their income toward needs, 30% toward wants, and 20% into savings. Living on campus at prestigious schools like the University of Toronto costs between $12,000 to $35,000 for eight months. Still, Canada offers many financial benefits to international students just waiting to be found.

This piece covers practical tips that really work - from student discounts that cut daily expenses to home cooking instead of dining out. You'll learn how to make money as an international student and survive in Canada without emptying your savings account.

Create a Realistic Budget First

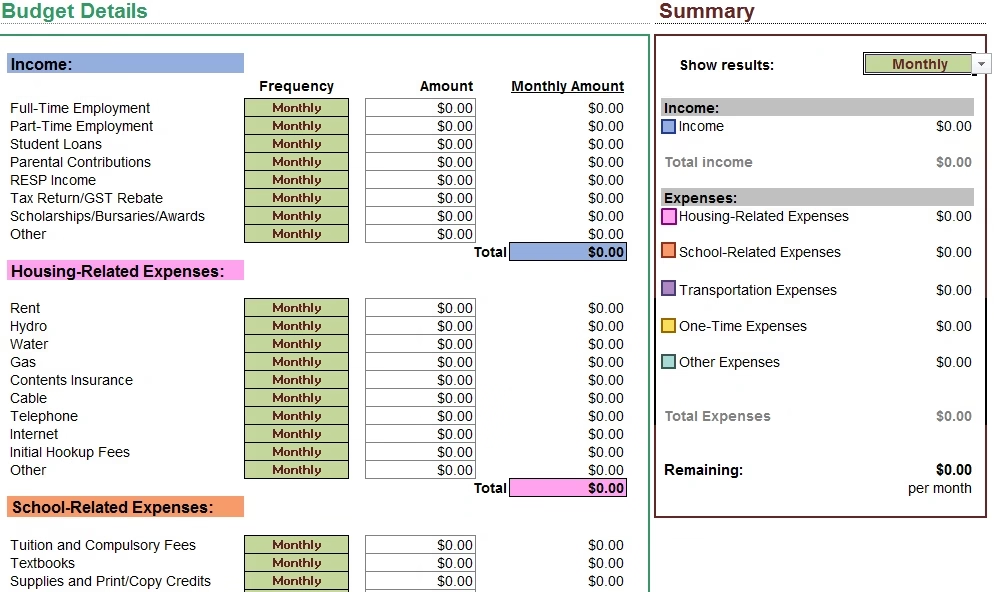

Image Source: My University Money

"Money can be a big source of stress for students, particularly while far from home." — Royal Bank of Canada, One of Canada's largest financial institutions serving international students

A solid budget is the life-blood of financial success for international students in Canada. Your budget acts as a financial roadmap that helps you stay on track and avoid unexpected money problems during the school year.

Track your income and expenses

The path to smart budgeting starts with a clear picture of your funds and expenses. List all your income sources:

- Student loans and financial aid

- Scholarships, grants, and bursaries

- Savings and family contributions

- Predicted work income (if eligible)

- Money invested in a Guaranteed Investment Certificate (GIC)

Most international students get their funds in lump sums as their academic year begins. So, careful allocation becomes significant to stretch these funds throughout your study period. The 50/30/20 rule works well—put 50% toward necessities, 30% for discretionary spending, and 20% into savings.

Use budgeting apps or spreadsheets

Once you know your income sources, tracking becomes vital. Several tools make this task easier.

Spreadsheets give you flexibility and customization options. Google Sheets lets you create detailed monthly budgets, group expenses, and use built-in functions that automate calculations. This direct approach makes you more aware of your spending habits.

Budgeting apps offer an easy-to-use experience with automatic grouping features. Here are some helpful apps from the factual keypoints:

- Goodbudget: Uses the digital envelope method to allocate specific amounts to different spending categories

- YNAB (You Need A Budget): A detailed financial planning tool that teaches you to give every dollar a purpose

- PocketGuard: Calculates your available spending money after covering essentials

Canadian banks provide student-specific budgeting tools in their mobile banking apps. TD MySpend helps students track spending and stay within their monthly budget.

Adjust your budget monthly

Your budget needs regular attention. Financial advisors recommend yearly reviews, but monthly checks work better.

First-time budgeters often underestimate their non-essential expenses. Regular tracking and budget adjustments help you understand your real spending habits better.

Your first month in Canada brings extra costs beyond regular expenses—like first and last month's rent, utility setup, and supplies for your new home. Set aside extra money for these original expenses.

Smart budgeting and money-saving strategies are the foundations of saving money in Canada as an international student. This disciplined approach to managing money becomes a valuable skill that lasts beyond your academic years.

Estimate and Reduce Your Major Expenses

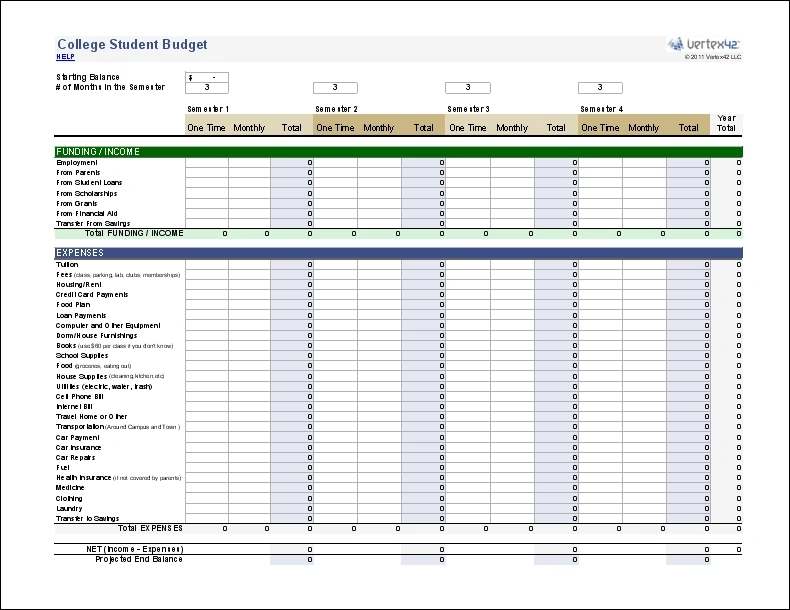

Image Source: Vertex42

Money management can make or break your student life in Canada. International students need to track their spending and find smart ways to cut costs. This approach will improve their financial health by a lot.

Compare tuition and program costs

Tuition fees are the biggest expense for international students in Canada. Your costs depend on where and what you study. International undergraduate students pay an average of $53,060 while domestic students pay just $9,859. Graduate programs cost international students about $30,738, compared to domestic students who pay $10,551.

Your field of study affects the cost too. Here's what you might pay:

- Business programs cost international undergraduates about $49,269

- Engineering programs average $51,040 for international students

- Medical degrees can reach up to $96,735 for international students

These price differences are a big deal, so research your options before applying. Some schools cost less than others. Memorial University in Newfoundland & Labrador charges international undergraduates between $17,974-$30,138, which is nowhere near what other universities charge.

Choose affordable housing options

Housing comes right after tuition in your expense list. The University of Toronto's on-campus housing costs between $16,720 to $48,767 for eight months. Dalhousie University in Halifax offers rooms from $8,360 to $14,630 per academic year.

Here's how you can save on housing:

- Share your place with roommates to split rent and utilities - you could save thousands each year.

- Work as a dormitory supervisor to get free rent or meal plans.

- Try housesitting or homestays to cut your housing costs.

- Check student housing forums to find shared rooms.

- Look for places a bit farther from campus - they're usually cheaper but still available.

Remember to budget for your first month's expenses like security deposits, utility setup, and basic supplies for your new home.

Plan for food, transport, and utilities

Daily expenses add up fast, but you can manage them well:

Food: College students typically spend $418-$473 monthly on groceries. Save money by:

- Making your own meals instead of eating out

- Creating a meal plan before shopping

- Shopping at budget stores with student discounts

- Getting non-perishable items in bulk

- Going to campus events with free food or sharing meals with friends

Transportation: Student passes for public transit cost less than owning a car with its insurance, maintenance, and fuel expenses. Many Canadian campuses let you walk or bike everywhere.

Utilities: Monthly bills run between $69-$300 based on your living setup. Splitting costs with roommates helps save money. Some rentals include utilities in the price, which might give you better value.

Smart planning and these money-saving tips help you handle major expenses while studying in Canada. You can still enjoy your student life without breaking the bank.

Find Ways to Earn While Studying

Image Source: U.S. News & World Report

Canadian international students have many ways to earn money while studying. This goes beyond just saving money. You can develop new skills and earn income to support your education with the right strategy.

Part-time jobs for international students

Starting November 8, 2024, you can work off-campus up to 24 hours per week during school terms. During scheduled breaks like summer and winter holidays, you can work unlimited hours. You'll need a Social Insurance Number (SIN) to work legally. Your study permit must also clearly state your work permission.

University positions are great options because on-campus jobs don't have hour restrictions. You must track your hours carefully if you work off-campus to follow immigration rules.

Remote work with foreign clients comes with a big advantage. These hours don't count toward your 24-hour weekly limit. This gives you a great chance to earn extra money while staying within your permit rules.

Work-study programs and internships

Co-op programs and internships are excellent ways to get Canadian work experience. You need both a study permit and a special co-op work permit. Your academic program must include work experience as part of the curriculum. The work part can't be more than 50% of your total program.

Big companies offer well-laid-out internship programs for international students. To name just one example, Microsoft offers paid internships in Vancouver lasting six months to one year. These come with competitive pay and help with relocation. The Mitacs Globalink Research Internship connects international undergraduates with Canadian researchers for 12-week projects.

The Federal Student Work Experience Program (FSWEP) helps international students gain experience in government departments.

Freelancing and online gigs

Freelancing fits perfectly with student life because it's flexible. International students can legally work for foreign clients without affecting their 24-hour work limit. Platforms like Upwork, Fiverr, and Freelancer help you find global work in content creation, programming, and design.

Digital skills pay well. Data annotation jobs can earn you up to CAD 42.93/hour. Virtual assistants make between CAD 25.08-48.77/hour based on their experience and clients. You can also tutor other students in academic subjects, which pays around CAD 26.54/hour.

Keep detailed records of all your freelance work. Include client details, project dates, and hours worked. This helps protect your immigration status and ensures you stay within work limits.

Use Student Discounts and Free Resources

Smart students know that saving money goes beyond budgeting and earning. Your student status in Canada opens up many ways to save money and stretch your dollars further.

Student ID perks and discount cards

A student ID works like a savings card. Students can get even more value by getting specialized discount cards:

The International Student Identity Card (ISIC) stands out as the only globally recognized student ID. It gives discounts in 130 countries and serves over 4.5 million student users annually. Students can save money on travel, shopping, museums, and various activities worldwide.

The Student Price Card (SPC) costs CAD 16.71 per year and lets you save up to 25% at more than 450 Canadian brands. Popular stores like H&M, Samsung, Hello Fresh, and Booking.com partner with SPC.

UNiDAYS gives students a free way to get exclusive discounts from popular brands online or through their app. You can register in five minutes and save at stores like Chef's Plate, Puma, and Microsoft.

Free campus events and services

Campus life brings countless free opportunities. Student Support Services runs weekly events where you can enjoy entertainment and free food. These gatherings let you build connections while saving on meals.

Schools offer informative events about their programs, admission needs, financial aid, and application steps. You can connect with faculty members who will guide you through your academic experience without extra costs.

Buy second-hand books and supplies

Textbooks take a big chunk of student budgets. Macleans reports that Canadian students spend about CAD 1077.07 yearly on books. Here's how you can cut these costs:

- Get used textbooks from campus bookstores

- Check online sites like Bookmob.ca

- Rent textbooks for short-term courses

- Find second-hand items on Facebook Marketplace, Poshmark, Kijiji, and thrift stores like Value Village

- Visit used bookstores that stock university textbooks

You can sell your books back to these stores after your courses end. This helps you recover some money while helping other students save too.

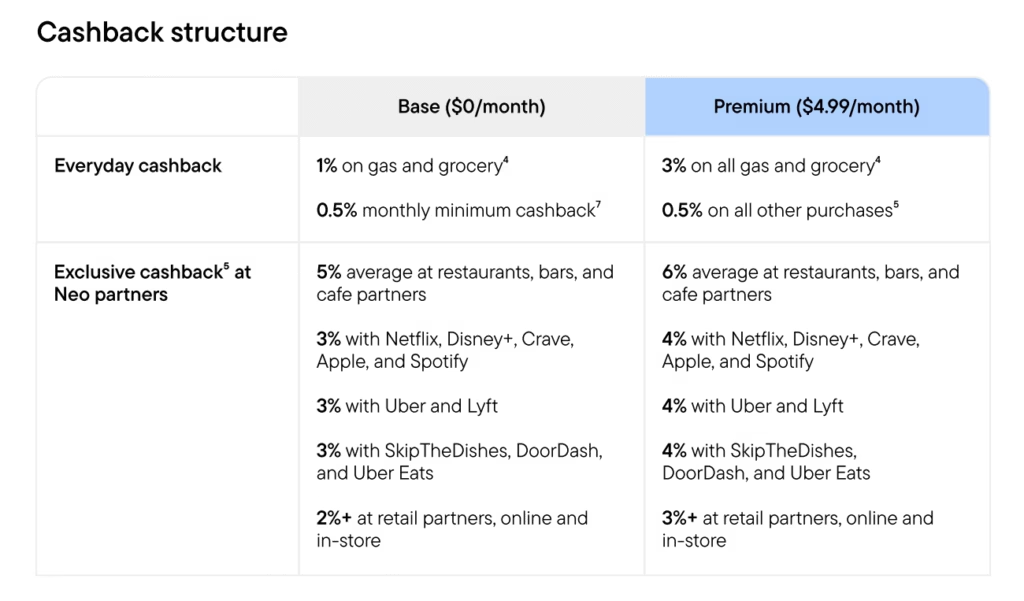

Open a Bank Account and Build Credit Wisely

A Canadian bank account and a good credit score are the foundations of financial stability in Canada. You can save hundreds of dollars each year through fee waivers and exclusive perks that major banks offer in their specialized packages.

Choose a student-friendly bank

You'll need specific documents to set up a Canadian bank account. Your study permit, passport, and proof of enrollment at a Canadian institution are what most banks want to see. Here are some great student-specific packages from major banks:

NEO Financial's zero-fee Everyday account is designed with your unique needs in mind. This account eliminates monthly fees, allowing you to save more while managing your finances effortlessly. Enjoy the convenience of online banking, free e-transfers, and access to a vast network of ATMs across Canada—all without the burden of hidden charges. NEO Financial understands the challenges faced by international students and offers a seamless way to handle your money while you focus on your studies. Don’t miss out on this opportunity to simplify your banking experience. Don’t miss out on this opportunity to simplify your financial life—sign up today

TD Student Chequing Account has unlimited transactions without monthly fees or minimum balance requirements. CIBC Smart Start is also great - it has no fees until you turn 25 and comes with unlimited Interac e-Transfers.

Scotiabank Student Banking Advantage Plan gives you free unlimited transactions, and you might get up to CAD 891.75 in cash and Scene+ points as a welcome bonus. RBC Advantage Banking for Students has a mobile app that's built specifically for students.

Understand credit cards and limits

Student credit cards are your first step to building a credit history in Canada. Many banks will give you one even without a previous credit history:

RBC gives international students credit limits up to CAD 2,786.72, and Scotiabank's limits can reach CAD 6,966.80. These cards usually have higher interest rates - about 20.99% for purchases and 22.99% for cash advances.

Your credit utilization is a big deal, as it means that your score can change based on how much credit you use. Keep it under 35% of your available limit. For example, with a CAD 2,000 credit limit, try to keep your balance below CAD 700.

Pay bills on time to build credit

Paying bills on time is the lifeblood of good credit. Set up automatic payments to make sure you never miss a due date.

You can track your progress with free annual credit reports from Canada's two main reporting agencies—Equifax and TransUnion. Look through these reports carefully and fix any errors that could hurt your score.

Note that utility bills won't help your credit score when paid on time, but they can definitely damage it if you're late. Make all your bill payments a priority to stay financially healthy during your studies.

Essential Money-Saving Tips for International Students in Canada

Final Thoughts on Managing Your Finances in Canada

Life as an international student in Canada comes with its financial hurdles. The good news? You can achieve financial stability with some practical steps. This piece shows how a realistic budget becomes the foundation of your financial success. Your financial situation improves by a lot when you combine this first step with smart ways to cut expenses.

Shared accommodations stand out as one of the best ways to slash your biggest regular expense - housing. You could save thousands of dollars every year by cooking at home instead of eating out. These little changes add up fast as time goes by.

Your path to financial stability becomes easier when you earn while studying. Students can work up to 24 hours weekly during school terms and unlimited hours during breaks. Remote work for foreign clients has no time limits. Students who grab these opportunities end up in much better financial positions.

Your student ID opens doors to savings that many people miss. Benefits range from cheaper transportation to budget-friendly textbooks. These perks are basically free money in your pocket through savings.

Building credit wisely and having a solid banking relationship paves the way to your long-term financial success in Canada. Banks love offering student packages with great perks and fee waivers. These can save you hundreds of dollars each year.

The money management skills you pick up during your studies will, without doubt, help you after graduation. These practical strategies let you focus on your education instead of worrying about money at the time of your Canadian adventure.