10 Hidden Liabilities Masquerading as Assets in 2025 (Financial Expert Warning)

Assets create economic value and future benefits. Liabilities are obligations you must settle through money, goods, or services. The difference looks simple on paper, but real-world application becomes complex. Liabilities come in two main types: current liabilities that need payment within 12 months, and non-current liabilities that extend beyond a year[-3].

Your balance sheet becomes dangerous when certain financial elements pose as positive entries. The balance sheet shows your company's total assets and their financing through debt or equity. These masked liabilities can affect your financial health severely. Some liabilities like loans can help owners finance their companies, but others quietly drain your resources.

I've found 10 risky financial items that could be hiding on your balance sheets in 2025. Let's expose these hidden liabilities and show you how to classify them correctly before they damage your financial stability.

Company Cars Under Lease

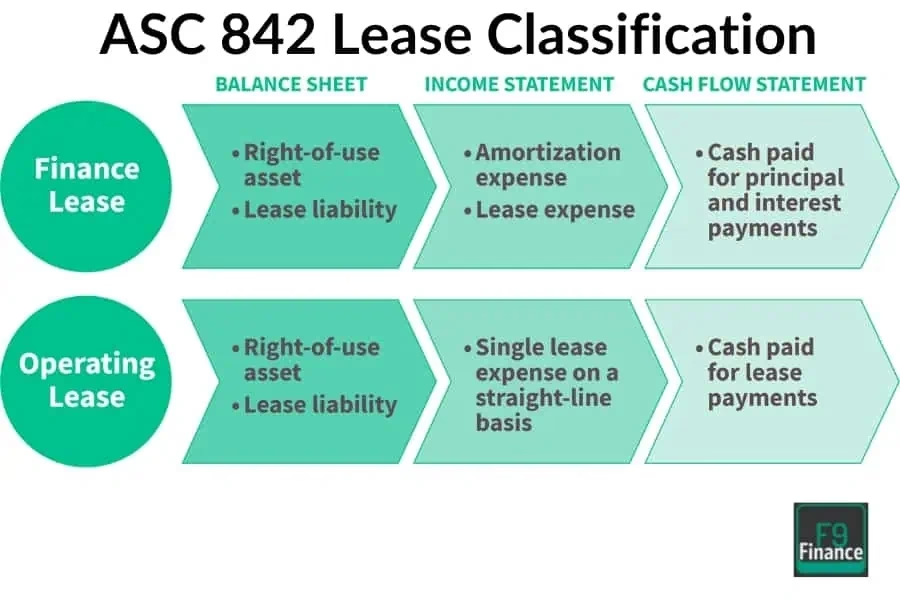

Image Source: Mike's F9 Finance

Company cars under lease are often misclassified on many corporate balance sheets. This confusion comes from not understanding the difference between control and ownership when figuring out assets vs liabilities.

Why leased company cars seem like assets

Leased vehicles give businesses real value through control and economic benefit. Companies control how these vehicles are used and get most of their economic benefits, which makes them work just like owned assets. It also helps that leasing needs lower monthly payments than buying, which frees up money for other investments. Companies with tight budgets find the lower upfront costs appealing, especially when they have limited funds. This creates an illusion that they're getting an asset.

The hidden liability behind leased company cars

Notwithstanding that, leased company cars create major financial obligations. Current accounting standards require companies to record both a "Right-of-Use" (ROU) asset and a "Lease Liability" on their balance sheets. The lease liability equals the present value of all future lease payments over the lease term. You're paying for the car's steepest depreciation period and then giving it back without building any equity.

Financial impact of leased company cars

The monthly lease payments might start lower, but they cost more over time since they never end as long as you keep getting new vehicles every 2-4 years. To cite an instance, a three-year lease might cost CAD 26,473.84 total, but the vehicle would be worth CAD 27,170.52 afterward. Leases usually come with mileage limits and possible charges if there's too much wear and tear.

How to correctly classify leased company cars

Current standards say you need to recognize both parts when classifying leased vehicles properly: the ROU asset (your right to use the vehicle) and the lease liability (your duty to make payments). All but one of these leases must show up as liabilities - only short-term leases under 12 months can skip this requirement. Personal financial statements should not list leased cars as assets. They're better viewed as long-term expense commitments.

Prepaid Expenses with No ROI

Image Source: HashMicro

Prepaid expenses show up as assets on balance sheets but they rarely give you a good return on investment. Many businesses make this asset vs liabilities classification mistake, and it can substantially hurt your financial health if you don't understand it properly.

Why prepaid expenses seem like assets

Your business makes payments in advance for goods or services that will benefit you later - these are prepaid expenses. The standard accounting principles tell us to treat these advance payments as assets because your business has already locked in future value. Here are some common examples:

- Prepaid insurance premiums

- Rent paid in advance

- Prepaid subscriptions and software licenses

- Advance tax payments

- Bulk orders of supplies

These items show up as current assets on your balance sheet because you'll get the service or good within the next year.

The hidden liability behind prepaid expenses

Your prepaid expenses might be classified as assets, but they lock up money you could use for other business operations or investments. This creates a hidden liability through lost chances. Your business misses out on interest or returns you could have earned by investing that money elsewhere.

Financial impact of prepaid expenses

Prepaid expenses reduce your available cash flow right now. This can make it harder to pay current bills and ended up affecting your net income. You might also struggle to get your money back if you need to move or downsize before the prepaid period ends. Your vendors get to use your money interest-free while you get nothing in return.

How to correctly classify prepaid expenses

The accrual accounting method lets you claim prepaid expenses in the years you actually get the benefit. Let's say you prepay CAD 836.02 for a three-year service contract in 2024. You can deduct CAD 557.34 in 2024 (for 2024 and 2025 portions), and the remaining CAD 278.67 in 2026. The value moves from your balance sheet to your income statement through an adjusting entry as you use these expenses.

Overvalued Inventory

Image Source: FasterCapital

Inventory stands as a major current asset on many balance sheets. Yet overvalued inventory represents one of the most dangerous financial misrepresentations that can distort your entire financial picture.

Why overvalued inventory seems like an asset

Inventory qualifies as a current asset because businesses expect to convert it into cash within one year. Balance sheets typically show inventories after cash and receivables under current assets. This placement reflects their relative liquidity. Many businesses look at large inventory numbers positively. They see them as valuable collateral to secure loans. Some companies even overstate inventory to show unusually high profits. They might do this to meet investor expectations, hit bonus targets, or satisfy loan requirements.

The hidden liability behind overvalued inventory

Overstated inventory creates a deceptive financial mirage. An overstated ending inventory leads to understated cost of goods sold (COGS). ABC Company's example shows this clearly. The company has beginning inventory of CAD 1,393.36, purchases of CAD 6,966.80, and correctly counted ending inventory of CAD 2,786.72. Its COGS should be CAD 5,573.44. However, if someone inflates the ending inventory to CAD 3,483.40, COGS drops to CAD 4,876.76. This CAD 696.68 ending inventory overstatement pulls COGS down by the same amount.

Financial impact of overvalued inventory

Overstated inventory inflates several financial metrics:

- Gross profit and net income rise artificially

- Current assets, total assets, and retained earnings look larger than reality

- Tax liabilities grow as companies pay taxes on overstated profits

ABC Company's case illustrates this well. A normal net profit before tax of CAD 4,876.76 jumps to CAD 5,573.44 with an inventory overstatement of CAD 696.68. At a 30% tax rate, this means throwing away CAD 209.00 in unnecessary taxes.

How to correctly classify overvalued inventory

Accurate inventory valuation needs constant alertness. Financial analysts should look for these warning signs:

- Higher inventory levels compared to sales or total assets

- Dropping inventory turnover

- Rising cost of sales as a percentage of sales

Inventory errors usually fix themselves after two years. Notwithstanding that, the damage to financial statements, investor confidence, and tax payments during those periods can be substantial. Sometimes these effects become irreversible.

Goodwill from Overpriced Acquisitions

Image Source: Eton Venture Services

Goodwill creates a phantom asset vs liabilities puzzle that surfaces when companies buy others at premium prices. This intangible element differs from physical assets discussed earlier and often conceals serious financial risks.

Why goodwill seems like an asset

Balance sheets show goodwill as an intangible asset that reflects the premium companies pay above fair market value during acquisitions. This excess becomes an asset because it captures valuable elements like brand reputation, customer relationships, and future earnings potential. Goodwill stands apart from other assets with its indefinite useful life and doesn't need amortization under most accounting standards. Companies must test it regularly for impairment instead. The math is straightforward: Goodwill equals Purchase Price minus Fair Value of Net Identifiable Assets.

The hidden liability behind goodwill

Goodwill often masks serious overpayment issues. Research shows 70-90% of acquisitions fail to benefit shareholders, with overvaluation as the main culprit. CEOs often get substantial pay raises after these deals, which raises questions about their motives. Companies pay excessive premiums due to competitive ego, rushed deal closures, and the "Pollyanna Principle" - the tendency to overvalue positive outcomes.

Financial impact of goodwill

Overvalued goodwill becomes a financial time bomb after recording. Failed acquisition benefits force companies to book impairment losses. These losses directly reduce net income, earnings per share, and stock prices. Companies that overpay typically see worse stock performance over five years compared to their peers. Microsoft shows this pattern clearly with its huge write-downs on LinkedIn (CAD 36.51 billion), Nokia (CAD 10.45 billion), and aQuantive (CAD 8.64 billion).

How to correctly classify goodwill

Smart goodwill management needs careful financial analysis before any acquisition. Setting strict price limits helps prevent emotional decisions. Companies must test for impairment yearly. The process starts with qualitative factors, and further testing happens only if a reporting unit's fair value might drop below its carrying amount. Any impairment loss equals the gap between carrying amount and fair value, but can't exceed the goodwill's carrying amount.

Uncollected Accounts Receivable

Image Source: Smith and Howard

Companies show accounts receivable as major entries on their balance sheets. Many businesses don't see the hidden risks when customers don't pay. The asset vs liabilities difference becomes especially blurry in this area.

Why accounts receivable seem like assets

Money owed to businesses for delivered goods or services shows up as accounts receivable. These appear directly on balance sheets as current assets and show expected cash coming in within a year. Phone companies create receivables by billing their customers at month-end for used services. Credit sales boost revenue and make receivables look valuable because customers prefer to pay later.

The hidden liability behind uncollected receivables

Some receivables never turn into cash. Uncollectible accounts become hidden liabilities when there's almost no chance of getting paid. These problems pop up through customer bankruptcies, missing debtors, fraud, or missing proof that debts exist. Receivables age after three months without payment and become "doubtful" as more time passes. Half of all business invoices in the U.S. get paid late, and 42% of companies spend more time chasing overdue accounts.

Financial impact of uncollected receivables

Unpaid receivables create major financial pressure. Cash flow disruptions can lead to liquidity problems and make it hard to pay immediate bills. Non-paying customers get interest-free loans, which hurts even more during high interest periods. Bad debt expenses from uncollectible accounts cut straight into profits. Companies spend about 14 hours each week—almost two full workdays—dealing with payment collection tasks.

How to correctly classify uncollected receivables

Smart businesses set up an allowance for doubtful accounts—a contra-asset that shows a more realistic value by reducing accounts receivable. This approach needs two entries: bad debt expense reduces profit and the allowance account lowers reported AR value. Customer balances stay unchanged, so everyone still owes their full amount officially. Regular checks of accounts receivable metrics help catch potential bad accounts early.

Deferred Revenue from Subscriptions

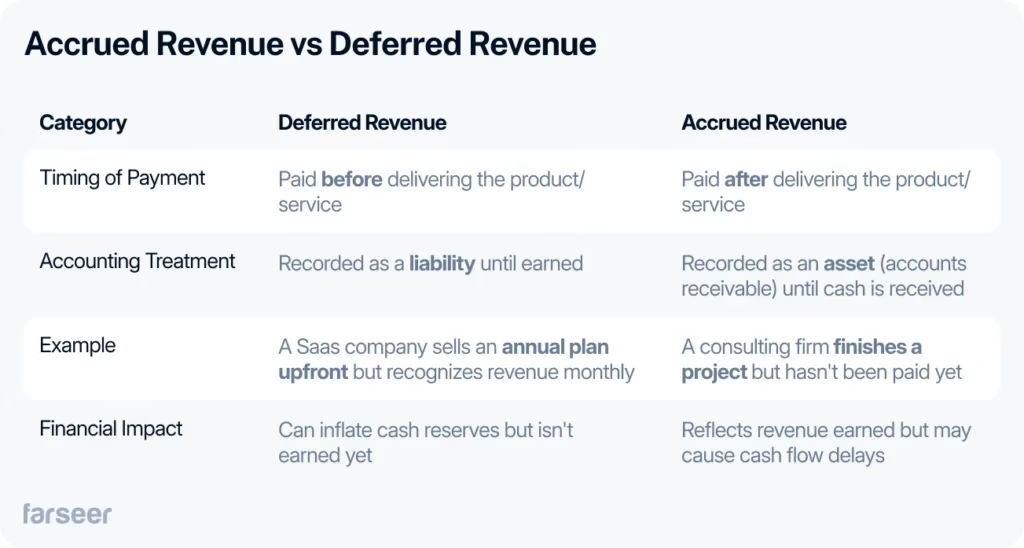

Image Source: Farseer

Subscription-based business models create a complex asset vs liabilities scenario. Advance payments often lead companies to misrepresent their financial position. This ranks among the most confusing accounting concepts that companies with recurring revenue streams face.

Why deferred revenue seems like an asset

Financial statements paint a deceptively positive picture of deferred revenue. Companies receive cash right away when customers pay upfront. This boosts bank balances and makes the balance sheet look stronger. Businesses record a debit to cash after collecting these payments, which creates an illusion of instant income. The immediate cash influx provides working capital and seems to improve liquidity ratios. To name just one example, see Microsoft's reported CAD 83.85 billion in deferred revenue in 2024—a massive sum that might give a false impression of financial strength.

The hidden liability behind deferred revenue

Deferred revenue actually represents an unfulfilled obligation. Accounting standards require companies to classify this income as a liability since they still owe products or services to customers. These funds remain a debt until a business delivers what it promised. Customers might ask for refunds before service delivery, so accounting principles treat these payments as liabilities. The revenue recognition principle clearly states that companies should recognize revenue only when earned—not at receipt.

Financial impact of deferred revenue

Deferred revenue affects each financial statement uniquely:

- Balance sheet: Shows up as a liability, either current or long-term

- Income statement: Nothing changes until recognition

- Cash flow statement: Shows the actual cash received

On top of that, it affects key financial metrics by initially reducing liquidity ratios and making the company look more leveraged. The cash flow advantages and temporary tax benefits offset these effects since unearned revenue usually isn't taxable until recognized.

How to correctly classify deferred revenue

Companies should record deferred revenue as a liability that changes into earned revenue as they deliver services. A customer who pays CAD 1,393.36 upfront for an annual subscription means the company should recognize CAD 116.11 monthly as earned revenue. Companies need clear recognition milestones based on service delivery. They should track this transition with appropriate software to meet accounting standards. Regular checks of deferred revenue balances against actual performance obligations help ensure accurate financial reporting.

Unrealized Gains on Investments

Unrealized investment gains create a risky zone in the asset vs liabilities world. These gains paint financial mirages that make accurate valuation difficult. Paper profits can fool even seasoned investors and financial managers.

Why unrealized gains seem like assets

Paper profits show up when investments grow in value but haven't been sold. To cite an instance, buying stock at CAD 41.80 per share that rises to CAD 58.52 gives you a paper gain of CAD 16.72 per share. These gains show up in your net worth calculations and appear as "accumulated other comprehensive income" in balance sheets' owner's equity section. Many investors see these paper profits as real wealth and use them to track their portfolio's growth.

The hidden liability behind unrealized gains

Paper profits come with several liability-like risks. Market prices might drop, and theoretical value could vanish. These gains can disappear quickly during economic downturns. The illusion of wealth leads to bad financial choices based on money that's not really there. Investors often hold onto assets too long and hope for more growth instead of taking actual profits.

Financial impact of unrealized gains

You can't use unrealized gains as cash flow or income until you sell the assets. This creates missed chances when investors avoid selling appreciated assets because they don't want to pay taxes. Rich individuals use this to their advantage. They live off loans backed by appreciated assets instead of selling them and paying capital gains taxes. This clever move helps them grow wealth without income tax bills.

How to correctly classify unrealized gains

Businesses should put unrealized gains in the "accumulated other comprehensive income" account within owner's equity—not on income statements. These gains move from equity to income statements after selling assets, becoming realized gains that face taxation. Remember never to count paper profits as current income. Your personal financial statements should treat these gains as potential wealth rather than actual money, so plan your finances carefully.

Vendor Credits Not Yet Applied

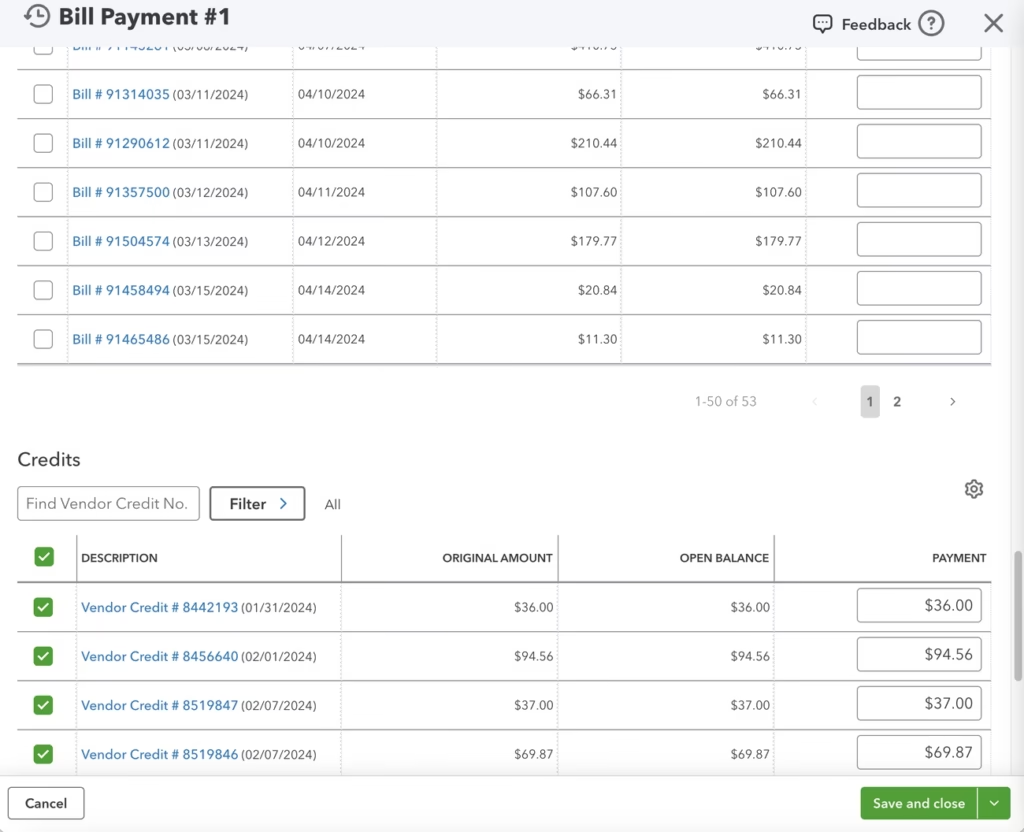

Image Source: QuickBooks - Intuit

Vendor credits create a complex entry in the asset vs liabilities equation. Many businesses misinterpret these credits on their financial statements. The resulting accounting confusion leads to errors in reporting.

Why vendor credits seem like assets

Your business receives vendor credits in several ways - through overpayments, merchandise returns, or post-invoice discount negotiations. These credits look positive because they represent money the vendor owes back to your business that you can use for future purchases. The credits appear as negative entries on balance sheets and seem to improve your financial position by reducing outstanding payables. Many companies view these credits as valuable resources that improve their buying power with suppliers.

The hidden liability behind vendor credits

A deceptive reality lies beneath this beneficial appearance. Your accounting team faces administrative challenges with unapplied vendor credits that can throw off accurate financial reporting. Managing multiple credits becomes harder without reliable systems. These credits often sit in accounting limbo - recorded but unused - and tie up financial resources in unclear balance sheet entries. Credits might expire if left inactive, which turns potential assets into permanent losses.

Financial impact of vendor credits

These credits affect more than just accounting entries. Unused credits will affect your cash flow management as companies miss chances to cut expenses through quick application. Your inactive credits give vendors interest-free loans, which goes against sound financial management principles. Small vendor credits add up over time and can reach amounts that could fund your operations or investments.

How to correctly classify vendor credits

The right approach treats vendor credits as contra-liabilities against accounts payable rather than independent assets. You should apply these credits to future vendor bills or create journal entries to move the amounts. Your team needs to reconcile vendor credit balances regularly against actual performance obligations. Financial management tools help track expiration dates and will give these credits real value through quick application.

Uninsured Business Risks

Image Source: FasterCapital

Many business owners make a dangerous mistake in the asset vs liabilities debate. They think not having insurance gives them a financial edge, which creates one of the riskiest misclassifications on any financial statement.

Why uninsured risks seem like assets

Not buying insurance looks like a smart financial move at first. Companies notice immediate savings on premium payments. About 40% of small businesses run without enough coverage. Half of these uninsured companies think they don't need any protection. This belief gets stronger when tight budgets force tough choices. Small firms often put their day-to-day operations ahead of what they see as "optional" protection.

The hidden liability behind uninsured risks

Uninsured risks are actually huge contingent liabilities. Companies without proper coverage must pay for damages, injuries, property losses, and legal expenses themselves. These risks go beyond physical threats and include data breaches, regulatory problems, and contract disputes. The numbers tell a harsh story. U.S. companies faced CAD 477.92 billion in total liability costs. Uninsured or self-insured businesses paid more than half of this amount - CAD 289.82 billion.

Financial impact of uninsured risks

Not having insurance can destroy a business. Companies lose income right after unexpected events hit. They must use their cash flow to pay for new equipment, fix property damage, or handle compensation claims. Customer trust takes a hit too. Large businesses often refuse to work with vendors who don't have insurance. A single bad event can shut down a business permanently if they can't recover financially.

How to correctly classify uninsured risks

Businesses need to list potential risks as contingent liabilities on their financial statements. They should assess industry-specific threats and coverage gaps regularly. Companies must know their assets' and operations' true value to get enough protection. A full coverage plan that handles multiple risk types is vital for staying financially stable and sustainable.

Pending Tax Audits

Image Source: Cube Software

Tax authorities' pending audits are a crucial yet often overlooked asset vs liabilities factor that can change a company's financial path dramatically.

Why pending audits seem like assets

Many businesses wrongly think pending tax audits are positive for their financial health. Companies sometimes see successful audits as proof of their compliance practices. This boosts their perceived stability. A favorable audit seems to protect against future scrutiny. Some businesses even brag about their "audit-proof" operations as a competitive edge.

The hidden liability behind tax audits

Tax audits put heavy burdens on companies, whatever the outcome. Companies must assign staff to answer questions, provide information, and defend their tax positions. Audits help promote compliance and stop aggressive tax behavior. Most executives (84%) know better tax risk management would add value to their business. Yet 61% say their tax teams rarely get involved in major business changes.

Financial impact of tax audits

The money impact hits hard. Companies that get audited are 1.2-6.0 percentage points more likely to fail than those that don't. This hits non-compliant businesses hardest - they become 2.7-12.6 percentage points less likely to survive after an audit. Companies that stay open see their reported revenues drop by 21.8% in later years. Tax rates go up permanently after audits too. Right now, 70% of senior tax leaders don't have a full picture of their global disputes.

How to correctly classify tax audits

Smart businesses should treat pending audits as contingent liabilities. CRA stands as Canada's biggest law enforcement agency with huge audit resources. Companies should know that hidden tax issues can be found and charged. Tax-compliant companies show similar survival rates to unaudited ones. Voluntary disclosure programs are a great way to handle potential tax issues before an audit. These programs help avoid harsh penalties and criminal charges.

Pending Tax Audits Mistaken for AssetsComparison Table

| Hidden Liability | Appears as Asset Because | Hidden Liability Aspect | Financial Effect | Proper Classification Method | Key Numerical Example |

| Company Cars Under Lease | Provides tangible value and control of vehicle | Creates major payment obligations | Continuous payments without building equity | Must record both ROU asset and lease liability | 3-year lease costs CAD 26,473.84 |

| Prepaid Expenses | Represents future economic benefits | Ties up capital that could be used elsewhere | Decreases current cash flow | Record expense in year of benefit | CAD 836.02 three-year contract example |

| Overvalued Inventory | Expected to convert to cash within one year | Creates misleading financial mirage | Inflates gross profit and tax liability | Regular monitoring of inventory metrics | CAD 696.68 overstatement example |

| Goodwill | Represents premium paid above market value | Often hides overpayment problems | Can lead to major impairment losses | Annual impairment testing required | Microsoft's LinkedIn write-down: CAD 36.51B |

| Uncollected Receivables | Represents money owed to business | May never turn into actual cash | 14 hours weekly spent on collections | Set up allowance for doubtful accounts | 50% of invoices paid late |

| Deferred Revenue | Immediate cash receipt | Shows unfulfilled obligations | Affects all three financial statements | Record as liability until earned | CAD 1,393.36 annual subscription example |

| Unrealized Gains | Shows paper profit increase | May vanish if prices decline | No actual cash flow until sale | Record in comprehensive income | CAD 16.72 per share example |

| Vendor Credits | Represents money owed back | Creates complex administrative tasks | Affects cash flow management | Treat as contra-liabilities | Not mentioned |

| Uninsured Risks | Immediate premium savings | Direct responsibility for damages | CAD 477.92B total liability costs | Record as contingent liabilities | 40% of small businesses uninsured |

| Pending Tax Audits | Can prove compliance practices | Needs substantial resource allocation | 21.8% lower reported revenues post-audit | Record as contingent liabilities | 1.2-6.0% higher business failure rate |

Conclusion

The difference between real assets and hidden liabilities plays a crucial role in financial stability for 2025 and beyond. This piece reveals ten dangerous financial elements that look positive on balance sheets while they quietly drain resources. Company cars on lease create major payment obligations, while overvalued inventory artificially boosts profits. These disguised liabilities can seriously affect your financial health if misclassified.

Businesses easily fall into these classification traps. Goodwill from expensive acquisitions, unpaid receivables, and deferred revenue create financial illusions that twist the true financial picture. Many organizations don't recognize contingent liabilities like uninsured business risks and pending tax audits until they face devastating risks.

Financial success needs constant watchfulness against these deceptive entries. Your company should set up proper classification systems, review finances regularly, and stay transparent in its coverage. This active strategy helps stop hidden liabilities from piling up that could cause unexpected losses, cash flow issues, or business failure.

A business's ability to thrive instead of just survive often depends on spotting these differences early. Companies that classify financial items correctly learn about their true financial position. They make smarter strategic decisions and build stronger foundations to grow sustainably. You can build wealth instead of draining it - book a free consultation today to ensure your financial statements show your business's true picture.

Note that financial health needs ongoing care. A regular look at your balance sheet, correct classification of financial items, and planning based on accurate data will protect your business from these hidden financial dangers over the last several years.

Key Takeaways

Financial experts warn that many items appearing as assets on balance sheets are actually hidden liabilities that can devastate your business in 2025. Here are the critical insights every business owner must understand:

• Leased company cars create ongoing payment obligations without building equity - while they provide control and economic benefit, they require recording both a Right-of-Use asset and corresponding lease liability on your balance sheet.

• Overvalued inventory artificially inflates profits and increases tax liability - a CAD 696.68 inventory overstatement directly reduces cost of goods sold by the same amount, leading to unnecessary tax payments.

• Uncollected accounts receivable drain resources through administrative costs - businesses spend approximately 14 hours weekly (nearly two full workdays) on collection activities, with 50% of invoices paid late.

• Goodwill from overpriced acquisitions often leads to major write-downs - studies show 70-90% of acquisitions fail to create shareholder value, with companies like Microsoft taking billions in goodwill impairments.

• Uninsured business risks represent massive contingent liabilities - 40% of small businesses operate without adequate coverage, yet uninsured companies shoulder over half of the CAD 477.92 billion in total liability costs.

The key to financial stability lies in proper classification and regular assessment of your balance sheet. These hidden liabilities can transform apparent financial strength into devastating weakness if not properly identified and managed through vigilant financial oversight.