How to Find the Cheapest Health Insurance for International Students in Canada

A single night's hospital stay in Canada can cost international students C$3,700 without proper health insurance. The good news? Health insurance for international students in Canada costs only C$600 to C$900 yearly.

Canada's growing community of 800,000 international students makes healthcare coverage a significant concern. Basic medical expenses add up quickly - a doctor's visit costs C$120, and emergency room visits start at C$1,000. These costs could drain your student budget rapidly.

This piece will help you find affordable student health insurance in Canada. You'll discover the best coverage options across Ontario, Manitoba, and other provinces that fit your budget perfectly.

Let's take a closer look at everything you need to know to protect your health and finances.

Understanding Health Insurance Costs in Canada

"Effective Sept. 1, 2019, all international K-12 and post-secondary students will begin paying a monthly health-care coverage fee of $37.50." — Government of British Columbia, Provincial government authority on healthcare policy

Health insurance costs for international students in Canadian provinces show different patterns that depend on location and coverage type. Students pay annual premiums between C$600 to C$900. These costs can vary substantially by province and insurance provider.

Average insurance costs by province

British Columbia's Medical Services Plan (MSP) charges international students C$104.50 monthly. This plan has doctor visits, diagnostic services, and hospital care. On top of that, students might need temporary coverage like GuardMe at C$2.69 per day.

Alberta offers a unique advantage through its Alberta Health Care Insurance Plan. Students who meet residency requirements can get coverage at reduced or no cost. Ontario takes a different approach and doesn't extend provincial healthcare to international students. They must get a University Health Insurance Plan (UHIP) through their schools.

Private insurance plans in provinces of all sizes typically cost between C$836.02 and C$1,254.02 yearly. These costs become crucial, especially when you have no insurance. A single day in the hospital could cost C$5,155.43, and a simple doctor's visit might run C$167.20.

Mandatory vs optional coverage

Many provinces have specific insurance requirements:

- British Columbia requires international students with study permits valid for six months or longer to enroll in MSP right after arrival

- Ontario makes UHIP mandatory for all university students

- Manitoba requires enrollment in the Manitoba International Student Health Plan for primary coverage

Coverage requirements depend on:

- Study permit length

- Province of residence

- Educational institution type

Some provinces, like British Columbia, Alberta, Newfoundland, and Labrador, let international students join provincial healthcare plans. Other provinces, such as Manitoba and Ontario, need private insurance arrangements.

University-sponsored health insurance plans usually cost between C$600 and C$800 per year. These plans often add services that provincial plans don't cover, such as:

- Prescription medications

- Dental care

- Vision coverage

Universities in provinces without free health coverage require students to buy private medical insurance. Several factors affect the cost:

- Duration of stay

- Student's age

- Pre-existing health conditions

- Coverage level selected

Note that health insurance fees don't include tuition costs. Some schools include insurance in their fee structure, while others need separate arrangements and payments.

How to Compare Insurance Plans

You need to evaluate coverage options and potential costs when choosing the right health insurance plan. Most Canadian educational institutions have health insurance packages, and some make them mandatory for international students.

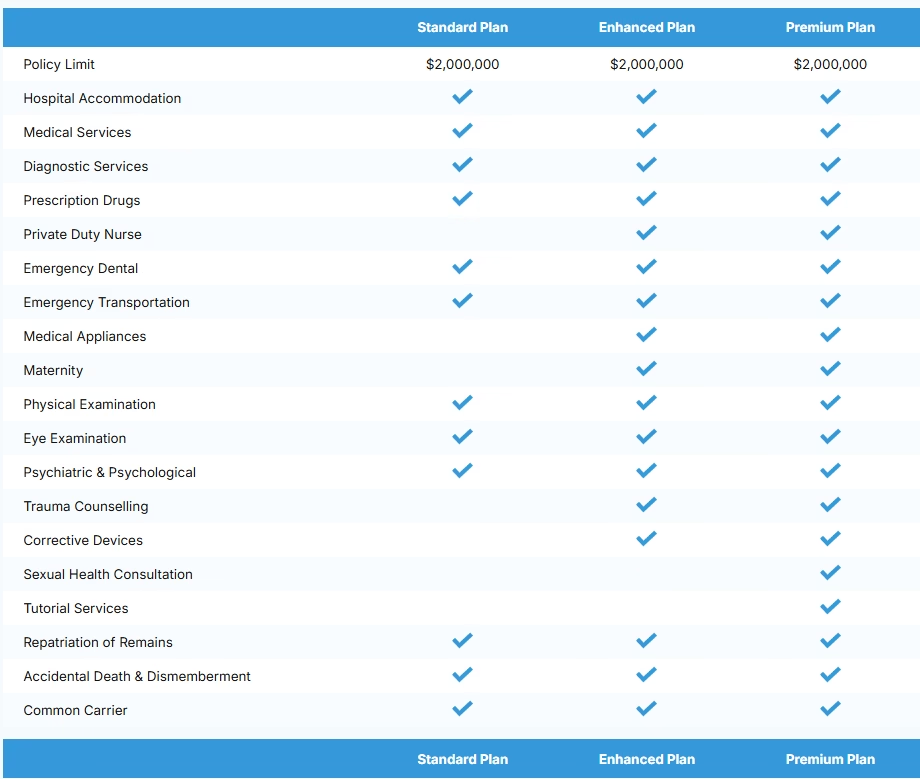

Basic vs comprehensive coverage

Basic insurance has essential medical services that mainly cover doctor visits and hospital care. Comprehensive plans go beyond basic coverage to include:

- Prescription medications for new conditions

- Emergency dental services

- Mental health services

- Physiotherapy and chiropractic visits

Provincial health plans' basic coverage costs between C$1.39 and C$2.79 per day. Extended coverage is vital for complete protection.

Reading the fine print

You should look into these significant elements before finalizing any insurance plan:

Coverage Limits: Look at maximum coverage amounts, which typically go up to C$2,786,720.40 for eligible emergency medical expenses.

Claims Process: Know how to file claims and when you can expect reimbursement.

Exclusions: Check what services aren't covered. A 2023 study showed all but one of these insured Canadians knew about their policy exclusions.

Emergency Services: Make sure you're covered for ambulance services, hospital stays, and urgent medical needs.

Renewal Terms: Review coverage duration and requirements to avoid gaps in protection.

Hidden fees to watch for

Students often miss these cost elements:

Deductibles: This is the original amount you pay before insurance kicks in. Lower deductibles make sense if you visit doctors often.

Co-payments: These are fixed amounts you pay for specific services. Knowing these helps avoid surprise expenses.

Out-of-pocket Maximum: This limits your total annual healthcare spending. Insurance covers 100% of eligible costs once you hit this limit.

Students who plan to travel outside their province of study should check if their coverage extends to other regions. If not, they'll need additional travel insurance.

Getting coverage beforehand is vital for those with pre-existing conditions. Even with controlled medical conditions, detailed insurance remains essential.

Your chosen plan should have repatriation and evacuation services - especially if you're an international student. Talk through different scenarios with your insurance provider to understand what's covered and how claims work.

The cheapest plan might cost you more later if you don't understand its coverage. Find a balance between cost and detailed coverage that lines up with your healthcare needs.

Smart Ways to Reduce Insurance Costs

"Our comprehensive and affordable health insurance plans are tailored for international students on OPT, with rates starting as low as $29/month." — International Student Insurance, Provider of international student health insurance

Getting affordable health insurance as an international student needs good planning. You have several ways to save money on insurance without losing quality coverage.

Group insurance options

Canadian schools team up with insurance providers to give students group health plans. These plans cost between C$600 to C$900 per year, which saves you money compared to getting insurance on your own.

Most universities require you to join their group insurance unless you can show you have similar coverage elsewhere. To cite an instance, see how undergraduate students who take at least four courses get automatic coverage through their school's health plan.

Group plans come with complete benefits:

- Direct drug payment cards for pharmacy costs

- Dental and vision care access

- Coverage for extra medical services

- Emergency medical treatment

Student discounts

Your age and health status give you an advantage as a student. Simple health insurance starts at C$84.99 monthly if you're healthy. The plans stay affordable even with existing health conditions, starting from C$137.94 per month.

Schools offer plans you can customize to fit your budget. These plans are a great way to get coverage when you can't use your parent's insurance anymore, which usually stops at age 25 for full-time students.

Annual vs monthly payments

The way you pay can save you money. Yearly payments often cost less than monthly ones. Here's what you should know:

- Monthly payments cost 4% more than annual ones

- Paying twice a year adds 2% to your costs

- A C$1,393.36 yearly premium jumps to C$1,449.09 with monthly payments

Insurance companies let you change your payment schedule when your policy renews. This means you can adjust how you pay based on your money situation.

Some schools add insurance fees to your student charges. Check if other payment options might save you money. Many schools also offer online claims and direct billing to reduce your upfront costs.

Here's how to save the most money:

- Look at both university and private insurance plans

- See if you qualify for provincial health coverage

- Look into family plans if you're bringing dependents

- Think over opt-out options if you already have insurance

Note that while finding cheap health insurance for international students matters, getting enough coverage should be your main goal. Good insurance helps you avoid big medical bills during your time studying in Canada.

Choosing the Right Coverage Level

Medical expenses in Canada can quickly add up. A single hospital stay costs upwards of C$5,155.43 per night. Getting the right coverage level is significant to manage these costs.

Essential coverage needs

The requirements for health insurance for international students differ in provinces, yet some simple coverages stay the same:

- Medical appointments and hospital care

- Emergency medical treatment

- Disease and injury coverage

- Single insurance plans are valid throughout your stay

Most schools require private health insurance plans. Government-funded insurance isn't available to international students in most provinces. These simple plans cost between C$836.02 and C$1,254.02 each year.

Here's what to think about when picking coverage:

- Duration of your study program

- Province-specific requirements

- Pre-existing medical conditions

- Budget constraints

Optional add-ons worth thinking about

Beyond simple coverage, several extra options might suit your needs:

Extended Health Benefits:

- Dental care (70% to 100% reimbursement up to C$1,045.02)

- Vision care services

- Prescription medications

- Physiotherapy sessions

- Massage therapy treatments

Additional Protection Options:

- Travel insurance for cross-province movement

- Mental health counseling services

- Medical equipment coverage

- Wellness programs

A routine dental visit costs about C$209.00. An MRI scan without insurance ranges from C$900 to C$2,400. That's why assessing these optional add-ons gives you detailed protection.

Some schools automatically sign up students for extra coverage through student unions or associations. These group plans often give you:

- Direct billing options

- Concierge services

- Language assistance

- Round-the-clock customer support

Start by looking at your health needs and predicted medical expenses. Then assess each insurance option based on:

- Coverage extent

- Premium costs

- Deductible amounts

- Inclusion of dental and vision services

- Mental health support availability

Note that simple provincial coverage, where available, doesn't include services like dental visits, chiropractors, physiotherapy, and similar specialized care. Extra insurance will give you full healthcare access.

Students with family members must get separate insurance policies right after arrival. This matches immigration rules and will give complete family protection during your Canadian stay.

Common Money-Saving Mistakes to Avoid

Students who pick the wrong health insurance plan face big financial challenges. A 2023 survey shows that 70% of Canadian students deal with financial stress, which makes avoiding insurance mistakes a vital priority.

Picking the cheapest plan without checking coverage

Students often choose simple plans just because of low premiums. These plans usually have limited coverage and higher out-of-pocket costs. Here's what you need to think over beyond the monthly cost:

Coverage Limitations:

- Simple medical needs versus detailed protection

- Network restrictions for healthcare providers

- Prescription drug coverage extent

- Emergency medical treatment limits

Private insurance plans might advertise extensive benefits but only partly cover needed services. The total value matters more than just premium costs. A detailed private insurance plan puts simple medical needs and extra benefits under one premium.

Travel insurance by itself won't cut it - it only covers emergencies. You need proper health insurance for standard medical expenses like doctor's visits and prescription refills. Educational institutions set specific coverage requirements, and some have their own group plans.

Ignoring deductibles and co-pays

Payment structures play a big role in figuring out real costs. Your deductible is what you pay before insurance kicks in. Co-payments are extra costs beyond your coverage limit that come straight from your pocket.

Key Payment Considerations:

- Monthly premiums versus annual payments

- Deductible amounts for different services

- Co-payment requirements for specific treatments

- Out-of-pocket maximums

High-deductible plans start at C$1,950.70 if you have individual coverage and C$3,901.41 for families. These plans have lower monthly premiums but cost more when you need medical care.

Here's what affects your insurance costs:

- Premium rates change based on age, gender, and where you live

- Monthly costs between ages 18 and 35 run from C$115.02 to C$127.21

- Coverage tiers substantially impact both benefits and costs

Private insurance costs vary based on:

- Age of the student

- Place of residence

- Chosen coverage level

- Pre-existing conditions

Simple plans might look good if you're healthy with minimal medical needs. Health conditions often need more detailed coverage. Getting ahead with health coverage helps you dodge major expenses down the road.

Your educational institution might require specific insurance enrollment. Ontario requires international students to get University Health Insurance Plan coverage. British Columbia makes Medical Services Plan enrollment mandatory for students with study permits valid beyond six months.

Prescription drug coverage differs among student health plans. Some include this benefit, while others need extra extended health insurance. Picking coverage levels that match your health needs ends up being more budget-friendly than choosing plans based on premium costs alone.

Conclusion

International students in Canada need to plan and research carefully to find affordable health insurance. Simple coverage costs C$600 to C$900 per year, which is reasonable compared to medical bills that can reach thousands of dollars.

Coverage rules vary by province in Canada. British Columbia's MSP charges C$104.50 monthly, while Alberta offers lower-cost options. Ontario requires students to enroll in UHIP through their schools.

Smart comparison strategies will help you get detailed coverage without spending too much. You should look beyond simple plans because dental care, prescriptions, and mental health support often need extra coverage. Take time to review coverage limits, claims processes, and hidden fees before choosing an insurance plan.

Group insurance options, student discounts, and annual payment plans can save you money. Simple plans might look attractive, but detailed coverage will protect you from unexpected medical expenses that could impact your studies.

Want to secure your health insurance coverage? Contact us today to find the perfect international student insurance plan for your needs and budget. The right health coverage will give you peace of mind during your Canadian education so you can focus on your studies and personal growth.