Smart investors have discovered a lesser-known strategy that many financial advisors overlook: building wealth through life insurance. Most people see life insurance as just a death benefit. However, wealthy individuals recognize that it serves as a powerful financial tool with numerous advantages.

Life insurance does more than protect - it builds wealth, helps with estate planning, and protects businesses. This makes it valuable for wealthy Canadians. Permanent life insurance stands out as a "non-correlated asset." Its value stays stable, whatever the market conditions.

The strategy's appeal comes from several key benefits. The cash value in a whole life insurance policy grows tax-free. Your beneficiaries typically receive death benefit payouts tax-free. On top of that, it lets you protect parts of your investment portfolio from those heavy taxes mentioned earlier when you invest through a permanent policy.

This piece will show you how to use life insurance as an investment tool and utilize its unique benefits to build wealth. You'll learn everything from using cash value for tax-free loans to protecting assets from creditors - strategies that millionaires have quietly used for decades to grow and protect their wealth.

People often think life insurance just pays out after death. This view overlooks a vital insight: some life insurance policies work as powerful financial assets that benefit you while you're alive.

Breaking the myth: It’s not just for death benefits

Permanent life insurance does more than provide simple protection. It combines a death benefit with a savings component that builds cash value as time passes. Your policy becomes an asset like an IRA or mutual fund. The cash value grows tax-deferred, and you won't pay taxes on this growth until you withdraw money. Some policies also earn dividends that can substantially improve your returns, though these aren't guaranteed.

This approach brings great value through its flexibility. Your policy's cash value becomes available in several ways:

- Taking withdrawals directly from the policy

- Borrowing against your policy through loans

- Using your policy as collateral for external loans

The right structure can help you avoid tax liability altogether. Life insurance stands out as a unique financial tool that gives both protection and ways to build wealth.

Permanent policies protect against market volatility. Unlike stocks and bonds, whole life insurance isn't subject to market risks, which makes it a stable investment choice. This provides a secure foundation in today's uncertain financial world.

How the wealthy use life insurance differently

Wealthy people see life insurance as more than protection—it's a sophisticated way to build wealth. They don't view premiums as costs but as investments in a versatile financial tool.

The wealthy make use of permanent life insurance policies to:

Create tax-advantaged savings - The cash value grows tax-deferred and smart planning lets you access it tax-free through policy loans.

Protect assets from creditors - Many jurisdictions protect life insurance policies from creditor claims, which helps preserve family wealth.

Fund estate taxes - Life insurance provides money to cover estate taxes so heirs don't need to sell valuable assets.

Equalize inheritances - Business owners can give their company to one heir while providing equal value to others through life insurance.

Vary investment portfolios - As a "non-correlated asset," permanent life insurance stays stable whatever the market conditions.

Affluent individuals know that whole life insurance builds generational wealth through guaranteed, tax-free death benefits and living benefits. These policies do more than replace income after death—they become strategic tools to transfer and preserve wealth.

Wealthy people also use premium financing. They borrow from third-party lenders to pay insurance premiums and use the policy's cash value and death benefit as collateral. This helps them keep money available for other investments while getting permanent life insurance benefits.

Through these strategies, wealthy people turn what seems like a simple protection product into the life-blood of detailed wealth management.

Top Strategies to Build Wealth with Life Insurance

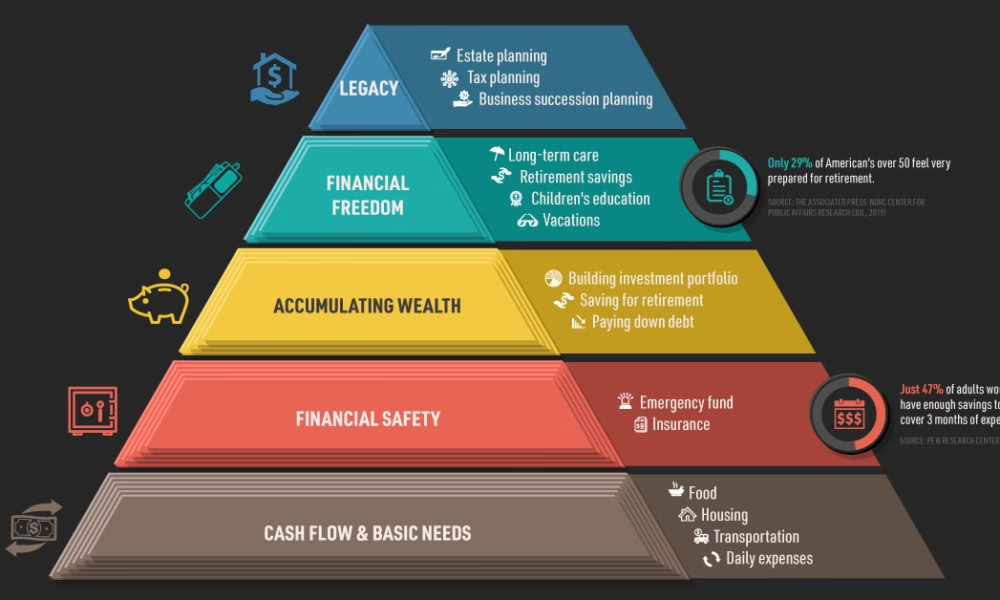

Image Source: Advisor Channel - Visual Capitalist

Life insurance can build wealth in ways that go way beyond the reach and influence of simple death benefits. Smart investors employ these policies as versatile financial tools to build and preserve wealth across generations. Here are eight powerful strategies that will revolutionize your financial future.

1. Use whole life insurance as an investment

Whole life insurance works like a forced savings vehicle with guaranteed returns. Your cash value component grows at a fixed rate guaranteed by your insurer. This growth doesn't get taxed until you withdraw the money. This option gives you an additional tax-sheltered savings opportunity if you have maxed out tax-advantaged accounts like 401(k)s or RRSPs.

2. Exploit cash value for tax-free loans

You can borrow against your policy once you've built up enough cash value. These loans come with lower interest rates (5% to 8%) than personal loans or credit cards. Current laws allow you to receive these policy loans tax-free. You won't need to repay these loans by any specific date, though outstanding balances reduce the death benefit. This strategy lets you access cash without triggering taxable events.

3. Fund estate taxes to preserve assets

Estate assets often trigger heavy tax obligations that might force liquidation. Life insurance provides immediate tax-free capital to cover these obligations, so your heirs can keep valuable assets intact. Joint last-to-die insurance coverage costs less than equivalent individual coverage. This is the quickest way to preserve your estate's full value.

4. Equalize inheritance among heirs

Life insurance solves the challenge of dividing estates with varying asset values. To name just one example, you might want to leave a cottage worth CAD 1,254,024 to one child and CAD 836,016 worth of investments to another. A CAD 418,008 life insurance policy could balance this inheritance. This approach keeps family harmony and ensures fair distribution.

5. Use life insurance for business buyouts

Life insurance effectively funds buy-sell agreements for business partners through these steps:

- Partners purchase cross-insurance on each other

- Surviving owners receive the tax-free death benefit

- These funds buy out the deceased partner's share

This setup ensures business continuity without costly interruptions, protects credit positions, and maintains management control. It's usually the most cost-effective and tax-efficient way to fund share purchases after a shareholder's death.

6. Create a charitable giving plan

You can make a big charitable impact through small premium payments. Your options include:

- Taking out a new policy naming the charity as owner and beneficiary

- Naming a charity as beneficiary of an existing policy

- Transferring ownership of an existing policy to a charity

Each method offers different tax advantages, including charitable tax receipts for premiums paid and potential estate tax benefits.

7. Protect assets from creditors

Life insurance policies receive protection from creditor claims in many jurisdictions. Your policy's cash value and death benefits stay safe from seizure, except when your estate is named as beneficiary. The right beneficiary designations create a financial safety net that remains secure even during tough financial times.

8. Vary your portfolio with non-market assets

Permanent life insurance works as a "non-correlated asset" - its value stays stable despite market changes. This makes it valuable for portfolio diversification by providing stability during market downturns. The guaranteed cash value growth delivers dependable returns whatever the economic conditions, balancing an investment strategy that might otherwise be vulnerable to market swings.

Understanding the Types of Life Insurance

Image Source: Wysh

Your wealth-building strategy needs the right type of life insurance as its foundation. Learning about different insurance options helps you pick a policy that matches your financial goals.

Term vs. permanent: What’s the difference?

Life insurance comes in two main types: term and permanent. Each plays a unique role in financial planning.

Term life insurance covers you for a set time—usually 10, 20, or 30 years. When it expires, your policy either ends or you can renew it at higher rates. Term policies cost less than permanent insurance at first and give you:

- No cash value buildup or investment part

- Lower starting premiums that go up when you renew

- No option to borrow from the policy

- Death benefits are paid tax-free only if you pass away during the term

Permanent life insurance protects you for life as long as you pay the premiums. It costs more upfront but comes with several benefits:

- Protection for life, whatever your health changes

- Premiums that never go up

- Cash value you can use while you're alive

- Tax advantages as your money grows

You'll find different types of permanent insurance, but whole life and universal life are the most common. Whole life has set premiums, guaranteed minimum cash values, and might pay dividends. Universal life lets you adjust premiums and investment choices, but has more risk.

Why whole life insurance is preferred for wealth building

Rich people often choose whole life insurance to build wealth. The numbers show this trend - 69% of life insurance premiums in Canada went to whole life policies in 2024.

Whole life insurance gives you lifelong protection and builds cash value without immediate taxes. Your policy works like in an IRA or mutual fund as a financial asset.

The policy guarantees growth at fixed rates, which you won't find in market investments. Your money grows tax-deferred, so you only pay taxes when you take it out—if ever.

Whole life insurance also helps spread out risk as a "non-correlated asset" that stays stable whatever the market does. You can tap into the cash value through withdrawals or loans when you need money for retirement, business, or emergencies.

Whole life insurance ended up creating a solid base for building wealth through guaranteed returns, tax benefits, and lifetime protection. This makes it a great choice if you earn a high income and want to optimize taxes while preserving wealth long-term.

Advanced Tools for High-Net-Worth Planning

Image Source: A Comprehensive Approach to Life Insurance and Policy Management

Wealthy individuals employ sophisticated financial tools to encourage engagement that maximizes their life insurance strategies. These advanced planning techniques offer advantages beyond simple policy benefits.

Setting up an Irrevocable Life Insurance Trust (ILIT)

An ILIT is a 20-year old legal entity that holds and manages life insurance policies. The trust becomes the policy owner and beneficiary, removing the death benefit from your taxable estate. Your estate tax liability could decrease substantially through this tax-efficient approach.

The trust operates through three parties: you (the grantor), a trustee who manages the trust, and your chosen beneficiaries. Your trustee handles premium payments and oversees distributions based on your specifications. This ensures wealth transfers exactly match your intentions.

ILITs protect assets from creditors and help beneficiaries with special needs stay eligible for government benefits.

Premium financing: Borrowing to fund policies

Premium financing lets high-net-worth individuals fund insurance premiums by borrowing from third-party lenders. The policy's cash value and death benefit act as collateral.

Your liquidity stays intact for other investments or expenses. This strategy can create positive financial arbitrage based on loan interest rates and policy performance. Premium financing needs:

- Borrowing 95% of the premium costs from a bank or specialized lender

- Interest payments throughout the loan term

- Extra collateral besides the policy itself

Using life insurance as collateral for business loans

Life insurance policies with cash value can secure business loans without putting other assets at risk. This strategy works when you:

- Conditionally appoint your lender as the primary beneficiary

- Give the lender right to claim a portion equal to the outstanding loan balance after death

- Direct remaining proceeds to your named beneficiaries

Lenders offer lower interest rates since this arrangement reduces their risk. Your full policy control returns once you repay the loan and end the collateral assignment.

Choosing the Right Policy and Advisor

Your wealth-building strategy needs the right life insurance policy and advisor as its foundation. This choice will affect how well you can use insurance as a financial tool.

How to arrange your policy with financial goals

You should identify your specific financial goals before buying any policy. Take stock of your assets, debts, and future needs. Then review if you need coverage for temporary needs, like mortgage payments, or permanent needs, such as wealth transfer. Your policy should work well with your financial strategy's other aspects to provide balance and diversification.

Questions to ask your insurance advisor

These important questions should be ready when you meet your insurance professional:

- What date does coverage take effect?

- Are the premiums guaranteed, or will they change?

- What exactly is not covered by this policy?

- How will this policy help me reach my long-term financial goals?

- What happens if I need to cancel or modify the policy?

Why regular policy reviews matter

Insurance experts suggest reviewing your policy every year or after major life changes. These reviews help your coverage adapt to your changing life circumstances. Regular check-ups can find potential savings, update beneficiaries, and adjust to changes in your financial goals. Let me help you set up the best insurance policy for you and your family with a free consultation. Regular reviews will help you keep appropriate protection while maximizing your wealth-building potential.

Conclusion

Life insurance is a powerful financial tool for wealth creation that many people overlook. This piece shows how permanent life insurance goes nowhere near just death benefits—it gives you tax advantages, asset protection, and stable growth whatever the market conditions.

Wealthy individuals have known these benefits for years. They use whole life policies to create tax-deferred savings, protect assets from creditors, fund estate taxes, and balance inheritances. These strategies are a great way to get advantages for business owners through buyout funding and loan collateralization.

Life insurance becomes valuable especially when you have versatility. You can access cash value through tax-free loans, use it to broaden your investment portfolio, or set up sophisticated structures like Irrevocable Life Insurance Trusts to maximize tax efficiency. Premium financing lets you use borrowed funds to pay premiums while you retain control of other investments.

Success depends on choosing the right type of policy. Whole life insurance, with its guaranteed growth and lifetime protection, has become the top choice for affluent Canadians who want stable wealth accumulation outside traditional investment vehicles.

Your wealth-building strategy must adapt as the digital world changes. Regular policy reviews with a knowledgeable advisor help your insurance meet your long-term goals effectively.

Life insurance changes from a simple death benefit into the life-blood of detailed wealth management with proper structure. These strategies can help you join successful investors who found that there was a millionaire's secret to building and preserving generational wealth.

Key Takeaways

Life insurance isn't just protection—it's a sophisticated wealth-building tool that millionaires use to create tax-advantaged savings, protect assets, and build generational wealth.

• Whole life insurance grows wealth tax-deferred - Cash value accumulates without annual taxes, and you can access funds through tax-free policy loans

• Use life insurance as a non-correlated asset - Unlike stocks and bonds, permanent policies provide stable growth regardless of market volatility

• Leverage advanced strategies for maximum benefit - Set up Irrevocable Life Insurance Trusts (ILITs) to remove death benefits from taxable estates and protect assets from creditors

• Access cash value for business and investment opportunities - Borrow against your policy at low rates or use it as collateral for business loans while maintaining liquidity

• Create tax-efficient estate planning solutions - Fund estate taxes without forcing asset liquidation and equalize inheritances among heirs through strategic policy structuring

The key is choosing whole life over term insurance and working with knowledgeable advisors who understand these advanced wealth-building applications. Regular policy reviews ensure your strategy evolves with your financial goals.

FAQs

Q1. How does whole life insurance differ from term life insurance for wealth building? Whole life insurance offers lifelong coverage with a cash value component that grows tax-deferred, making it a powerful wealth-building tool. Term life insurance, on the other hand, provides coverage for a specific period without cash value accumulation, making it less suitable for long-term wealth creation.

Q2. Can I access the cash value of my life insurance policy without tax consequences? Yes, you can access the cash value of your whole life insurance policy through policy loans, which are typically tax-free. This allows you to use the accumulated cash value for various purposes without triggering taxable events, as long as the policy remains in force.

Q3. How can life insurance help with estate planning and inheritance? Life insurance can be used to fund estate taxes, preventing the need to liquidate valuable assets. It can also help equalize inheritances among heirs, especially when leaving assets of varying values to different beneficiaries. Additionally, setting up an Irrevocable Life Insurance Trust (ILIT) can provide tax advantages and asset protection.

Q4. Is life insurance protected from creditors? In many jurisdictions, life insurance policies receive protection from creditor claims. This means that the cash value and death benefits of your policy are typically exempt from seizure, providing a financial safety net even during challenging financial circumstances.

Q5. How often should I review my life insurance policy? It's recommended to review your life insurance policy annually or after major life events. Regular reviews help ensure your coverage aligns with your changing financial goals, identify potential cost savings, update beneficiaries, and maximize the policy's wealth-building potential.