Tired of hunting for insurance tips that don't force you to switch companies? I get it. Stay tuned to save on insurance.

Climate change worries three-quarters of Canadians as insurance rates continue to climb. Finding ways to cut premiums matters more than ever now. The good news? You can save money without the hassle of changing providers.

You could save up to 15% by bundling your home and auto policies with one provider - that's one of the quickest ways to reduce costs. On top of that, some insurers ask for just one deductible if the same incident damages both your car and home.

Bundling isn't your only option, though. We've found seven proven ways to cut your insurance costs while keeping your current provider. These range from telematics programs that give you an instant 10% discount just for joining, to loyalty rewards and policy updates after life changes. Remember that different companies charge varying prices for identical benefits. You just need to use this information to your advantage.

Let's dive into these money-saving strategies that can help you cut down your insurance costs without switching providers.

Use Telematics to Unlock Usage-Based Discounts

Image Source: Cheep Insurance

Want to save money on car insurance using the latest tech? Telematics insurance programs are changing how Canadians can save money without switching providers. These programs give you discounts based on your actual driving habits instead of traditional rating factors.

Telematics insurance overview

Telematics combines telecommunications and informatics. It tracks and analyzes your driving behavior through a smartphone app or a device in your vehicle. The technology collects data about your driving and sends it to your insurance provider. This creates your personalized risk profile.

Most telematics programs monitor:

- Braking and acceleration patterns

- Adherence to speed limits

- Time of day you drive

- Cornering techniques

- Phone usage while driving

- Total distance traveled

Traditional insurance depends on demographic information and driving history. Telematics gives live data about your actual driving habits. The system starts tracking your behavior as soon as you install it. This creates a dynamic picture of your risk profile.

"Usage-based insurance adjusts your policy rate by tracking how fast you drive, braking, phone use, and more," explains one industry expert. Insurance companies can now set rates that match your individual risk instead of relying on statistical averages.

How telematics helps Canadians save

Telematics programs offer great financial benefits. Insurance companies give you a 5-10% discount just for signing up. Safe drivers can earn extra discounts between 10-30% after the first six months based on their driving data.

Recent surveys show telematics users saved CAD 167.20 per year on average. Savings varied by age group. Drivers under 45 saved CAD 202.04 on average, while those between 45-59 saved CAD 142.12.

Families with three or more drivers saved even more money. Black (CAD 259.16) and Latino (CAD 242.44) policyholders reported higher savings than white (CAD 136.55) and Asian (CAD 151.88) policyholders.

Drivers can save up to 60% by switching to usage-based insurance, depending on their mileage. Pay-as-you-go models work best for people who don't drive much.

Telematics programs give you more than just lower premiums:

- Better driving habits

- Feedback to improve your skills

- Help finding stolen vehicles

- Faster insurance claims

- Better fuel efficiency through improved driving

Best telematics programs in Canada

Canadian insurers now have several competitive telematics programs. Each offers unique features and savings:

Intact MyDrive: You get a 10% discount for signing up and can save up to 30%. The program looks at three things: speed, focus, and smoothness. Your premium can go up or down based on the data.

CAA MyPace: This program works best if you drive less than 9,000 km yearly. It focuses on distance rather than driving habits.

Aviva Journey: You get a 10% discount in your first year for signing up. Safe drivers can save up to 20% in later years. Risky driving might increase your premium by 5% next year.

Pembridge My_Bridge: You can save up to 30% based on driving habits and get a 15% signup discount. Pembridge lets you keep your earned discount without ongoing data collection.

Travelers IntelliDrive: This 90-day program watches your driving and offers up to 30% savings at renewal for safe driving. But risky driving could add a 10% surcharge.

Think about these points when picking a telematics program:

- What specific driving behaviors are tracked

- Whether premiums can increase based on data

- The duration of the monitoring period

- Initial enrollment discounts versus long-term savings

- Whether the program requires a device or uses a smartphone app

Canadians have embraced telematics. A recent international survey shows more than half of policyholders want to try these programs. Millennials and Generation X drivers recommend this technology the most.

Usage-based insurance is available in Alberta, Ontario, Quebec, New Brunswick, Prince Edward Island, and Nova Scotia. Most Canadians can now save money without changing their insurance provider.

Leverage Loyalty Rewards Without Switching Providers

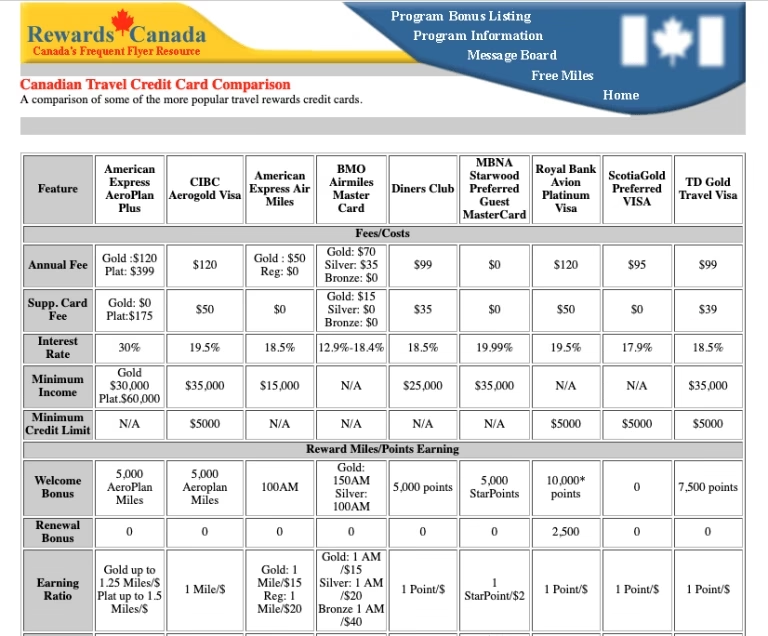

Image Source: Rewards Canada

Most Canadians think switching providers is the only way to cut insurance costs. Loyal customers can actually save more money through hidden perks that add up over time. Here's a look at these overlooked benefits that reward your dedication.

What are loyalty discounts?

Insurance companies give premium reductions and special perks to thank customers who stick with them. These rewards get better the longer you stay with your provider.

Insurance companies offer several types of loyalty programs:

- Discount programs: Reduced premiums that increase with policy tenure, often starting at 5% and growing to 10% after 10+ years

- Claims-free rewards: Extra discounts or lower deductibles if you maintain a clean claims record

- Cash-back programs: Return a percentage of premiums as either cash or credit toward future payments

- Referral programs: Incentives for referring new clients, such as Trupanion's program that rewards customers with CAD 34.83 for each successful referral

- Lifestyle rewards: Points and perks for activities beyond insurance

Your loyalty discount grows based on how long you stay with the company. Car insurance loyalty discounts typically follow this pattern:

- 1-5 years – save up to 5%

- 6 years – save up to 6%

- 7 years – save up to 7%

- 8 years – save up to 8%

- 9 years – save up to 9%

- 10+ years – save up to 10%

Research shows 84% of customers stick with brands that offer loyalty programs, making these incentives beneficial for both insurers and policyholders.

How to qualify for loyalty rewards

Getting loyalty rewards is simple but differs between insurance companies. You need to keep continuous coverage with the same provider for a specific time—usually one to three years before discounts kick in.

Your eligibility depends on several factors:

- Length of relationship: Most insurers need at least 3 years of continuous coverage before offering substantial loyalty discounts

- Claims history: A claims-free record boosts your discount eligibility and percentage

- Policy renewal timing: Early policy renewals can earn you up to 10% in discounts

- Bundled policies: Having multiple insurance products with one company often leads to better loyalty benefits

- Customer relationship: Good communication and timely payments with your insurer matter

You might not lose all loyalty benefits when switching insurers. Some companies honor loyalty to previous insurers through "New Business Loyalty Discounts," giving immediate savings of 5-15% to new customers.

Examples of insurers offering loyalty perks

Canadian insurers have created unique loyalty programs that go beyond basic premium discounts:

Co-operators has a complete loyalty package with preferred rates on first renewal, claims-free discounts up to 30% for homes without claims for 5+ years, and a disappearing deductible that drops by CAD 139.34 yearly (down to CAD 0.00) for claims-free years.

Their "Claim Forgiveness" feature protects your first claim from affecting premiums or your disappearing deductible—you get this free when you add two other products, like auto and life insurance.

Beneva rewards each claim-free year with a CAD 69.67 reduction on deductibles for home, car, and recreational vehicle insurance.

Manulife works with Aeroplan as Canada's first Group Benefits Provider to give Aeroplan Points for health-supporting activities. Members earn points by exercising, practicing mindfulness, and taking benefits-related courses.

These loyalty programs work well. Customers who join spend 12-18% more than others, and 72% of consumers see loyalty programs as key to their brand relationships.

Need help finding the best policy combination to maximize loyalty benefits? Let us review your bundling options to help you get all possible discounts from your current provider.

Your loyalty benefits only work if your insurer knows about your continued business. Regular policy reviews and open communication about available loyalty programs will help you find these hidden savings opportunities.

Update Your Policy After Home or Life Changes

Your insurance coverage might need adjustments as your life evolves. Most policyholders don't realize how these changes can affect their coverage. You can optimize your coverage and reduce costs by updating your policy after major life events. This works better than just relying on loyalty programs and telematics.

Why policy updates matter

Not updating your insurance after life changes can leave dangerous coverage gaps. Your insurer might deny future claims if you don't tell them about big changes in your life. Some policies list notification requirements as a "condition precedent to coverage." This means your protection could become legally void if you don't comply.

Policies that aren't current often lead to:

- Paying too much for coverage you don't need

- Not enough protection for new assets

- Missing out on discounts

- Claims getting denied because of wrong information

About 84% of customers find coverage gaps only when they file claims—usually when it's too late. So yearly policy reviews help spot these issues before they turn into expensive problems.

Common life changes that affect insurance

These major life events need quick insurance updates:

Marriage or Divorce - Your policies change when you add or remove a spouse. Health and dental plans might cover your new spouse, and you'll need to update life insurance beneficiaries. Divorce means looking at joint policies and figuring out the right coverage levels.

Home Purchase or Renovation - Buying property changes your insurance needs because mortgage lenders usually want proper coverage. Big renovations like redoing your basement or adding rooms can change your property's value. This means you might need more coverage.

Family Changes - New parents should look at their life insurance to protect their children's future. Adult children moving back home means updating your policy to cover their belongings and possible liability.

Valuable Acquisitions - Regular coverage limits might not be enough for inherited jewelry, art, or electronics. Let's say your personal property coverage is CAD 69,668 and you inherit items worth CAD 27,867. You'll need to tell your insurer to get proper protection.

Working From Home - Regular home insurance covers just personal use of your property. You might need business-specific coverage if you've started working from home.

Security System Installation - Your premium could go down if you install alarm systems. Let your insurer know right away after adding security features to save money.

How to notify your insurer

Different providers have different rules for updates. Here's how to make sure everything goes smoothly:

- Check notification methods - Your policy shows how you can communicate changes. Most insurers take updates through email, letter, fax, phone, or your broker.

- Timing matters - Quick reporting helps. Some policies give you 30 days after moving while still covering personal property. Adding dependents? Some plans need to know within 60 days to avoid waiting periods.

- Document everything - Save copies of all insurer communications. These records show you did your part if questions come up later.

- Update all affected policies - One life change can touch multiple insurance products. Think about how it changes your auto, home, life, and health policies.

Keeping your policies current helps in two ways. You get the right coverage during life changes and might find ways to save money without switching providers. This simple step takes little time but gives you peace of mind and could reduce your costs.

Tap Into Group and Membership Discounts

Your affiliations and memberships might hold a hidden treasure: significant insurance savings. Most Canadians haven't realized that their professional associations, alumni connections, or employer relationships could lead to substantial insurance discounts with their current providers.

What are group insurance discounts?

Customers who belong to specific educational, professional, employer, or affinity groups can get preferred rates through group insurance discounts. Insurance companies create partnerships with these organizations to provide plans that won't cost you or your association anything extra.

The benefit is clear: you pay lower premiums. Your home or auto insurance coverage stays the same, but you get an exclusive group discount. Some providers go beyond reduced rates by offering additional benefits through partners, tools, and offers that help improve your financial situation.

These discount plans give employers and associations a way to boost their total rewards package while increasing member participation. The biggest advantage is that members can save money and reduce their financial stress.

You can apply these discounts to both home and auto policies in most cases, though some might be limited to one insurance type. The best price comes automatically from insurers if you belong to multiple eligible groups, but you can only use one discount per policy.

Eligible associations and alumni groups

Group insurance discounts are available through several organizational types:

- Professional associations - Organizations like the Chartered Professional Accountants of Ontario give their members exclusive discounts on home, condo, tenant, car, and travel insurance through partners like TD Insurance. OAA status architects can save up to 33% on home and auto insurance.

- Alumni associations - Special rates are available to graduates from more than 40 top Canadian universities and colleges. Car insurance discounts, along with home, tenant, and condo coverage, are offered by most Canadian universities to their alumni. Sonnet Insurance extends Canadian Alumni University group discounts to students and graduates from almost every Canadian university.

- Employer groups - More than 800 employer groups in Canada have formed partnerships with insurers like Aviva. These deals often include lower prices plus extra benefits and savings, combined with flexible payment options.

- Affinity groups - Retiree organizations, financial institutions, retailers, and specialty groups join alumni and professional associations in this category. Manulife provides insurance products to more than 200 such groups throughout Canada.

- Military and emergency services - Canadian Armed Forces members can get special rates from various insurance providers.

The sort of thing I love is how some insurers like Sonnet collaborate with more than 2,000 organizations to offer group discounts.

How to apply for group rates

Getting group discounts becomes easy once you know the steps:

- Check eligibility - Your association's website, alumni page, or direct contact can confirm available insurance partnerships. Your current insurer might also know about group affiliations they accept.

- Verification process - Look for a "Group Discount" field while getting your home or auto quote. Choose your employer, association, or educational institution from the dropdown menu.

- Provide documentation - Your group ID or graduation year will be needed to confirm eligibility. Insurers use this information to verify your membership and apply the right discount automatically.

- Apply the discount - The system shows "Discount applied" throughout the quote process after verification.

- Update existing policies - Adding group discounts to current policies is possible. Just log into your account, choose the policy you want to update, and add your group discount by following the prompts.

It's worth mentioning that these discounts work with both new and existing policies. You should contact your insurer right away if you discover your eligibility - there's no need to wait for renewal time to start saving.

Different insurers have different verification requirements. Some might need extra documentation, while others can verify electronically using your member ID or graduation details.

Improve Your Home’s Safety for Hidden Home Insurance Savings

Image Source: PROLINK Insurance

Your home's safety upgrades can protect your family better and save you money on insurance without switching providers. Most Canadian homeowners don't know that a few safety improvements can reduce premiums by 5-25% based on the upgrades and their insurance company's policies.

Home upgrades that reduce risk

Insurance companies calculate premiums based on risk assessment. Safety features that minimize hazards make you a lower-risk client who deserves better rates. Here are the home improvements that usually qualify for discounts:

- Water damage prevention systems (leak detection devices and automatic water shut-off valves)

- Fire prevention and detection equipment (beyond simple smoke alarms)

- Security systems and monitoring services

- Structural reinforcements against weather events

- Electrical system upgrades to modern standards

These improvements target the most frequent home insurance claims. In fact, water damage makes up about 50% of home insurance claims in Canada, which explains why insurance companies reward prevention measures.

Examples: roof, plumbing, security systems

Roof Improvements: A new roof with impact-resistant materials can cut your premiums by 5-10%. Metal roofs or those with Class 4 impact resistance ratings often get the highest discounts because they handle hail and severe weather better.

Plumbing Upgrades: New copper or PEX piping that replaces old materials like polybutylene or galvanized steel can lower water damage risk. Automatic water shut-off systems that spot leaks and stop flooding might save you 5-15% on premiums.

Security Systems: Houses with monitored security systems can save 5-20% on insurance. Simple systems with door/window sensors start with small savings, while advanced systems with video surveillance, motion detectors, and 24/7 professional monitoring tap into the full discount potential.

How to report upgrades to your insurer

Here's how you can get these hidden savings:

- Document everything - Save all receipts, contracts, and photographs of improvements

- Contact your insurer proactively - Don't wait for renewal time

- Request a home insurance review - Ask about safety improvement discounts

- Provide proof of installation - Most insurers need professional installation certification

- Consider a new home inspection - Major renovations might need an updated inspection report

Safety improvements pay for themselves through prevented damage and lower premiums. Regular maintenance of these systems will keep your discounts going year after year.

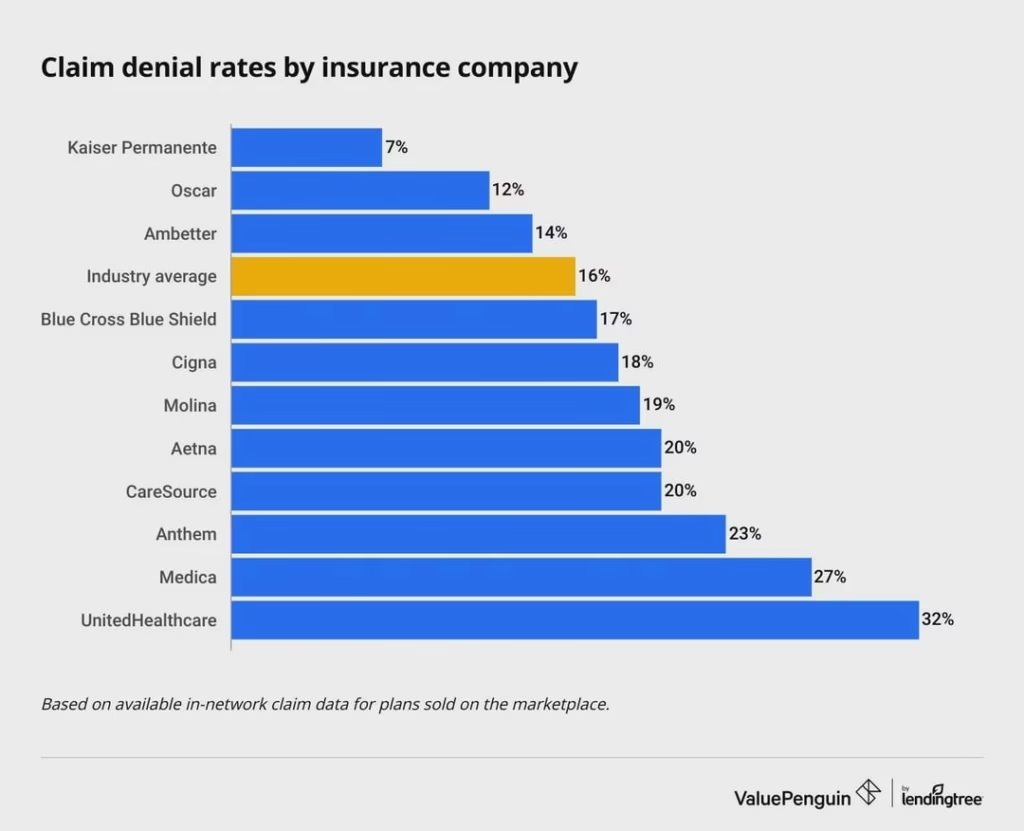

Avoid Filing Small Claims to Keep Premiums Low

Image Source: Reddit

Filing insurance claims might seem like the obvious choice after an accident. Small claims can backfire financially, though. Insurance companies see claims as risk indicators and often adjust premiums higher than your original payout.

Why small claims can cost more long-term

Your risk profile shoots up dramatically if you file multiple claims quickly. A single claim can raise your premiums by 10-20% for up to three years. A CAD 1,114 fender repair could end up costing CAD 2,926 in premium increases - that's more than 2.5 times what you'd pay for the repair itself.

Insurance companies follow a simple rule: more claims mean higher risk. TD Insurance gives claims-free drivers an average 30% discount. File too many claims, and you might lose your policy renewal completely.

When to pay out-of-pocket

You should handle repairs yourself when:

- Repair costs are close to or just above your deductible

- You've filed another claim in the last three years

- The damage is mostly cosmetic

- Premium increases would cost more than your claim payout minus the deductible

Here's a simple way to decide: If (Repair Cost - Deductible) < (Potential Premium Increase × 3 years), paying yourself makes more sense. Let's say a repair costs CAD 1,672 with a CAD 697 deductible. That leaves CAD 975 in insurance coverage. A CAD 418 yearly premium increase for three years totals CAD 1,254. Paying yourself would save about CAD 279.

How to maintain a claims-free record

Smart prevention and decision-making help keep your claims-free status. Raising your deductible makes sense if you plan to handle minor damages. Your premiums will drop and match how you use your insurance.

Start an emergency fund just for car and home repairs. This money helps you handle out-of-pocket costs without stress when minor incidents happen.

Get repair estimates before you call your insurer. This gives you the power to make smart choices based on real costs.

Accident forgiveness endorsements can protect your claims-free status. Many Canadian insurers offer this for your first at-fault crash, usually after six years without claims.

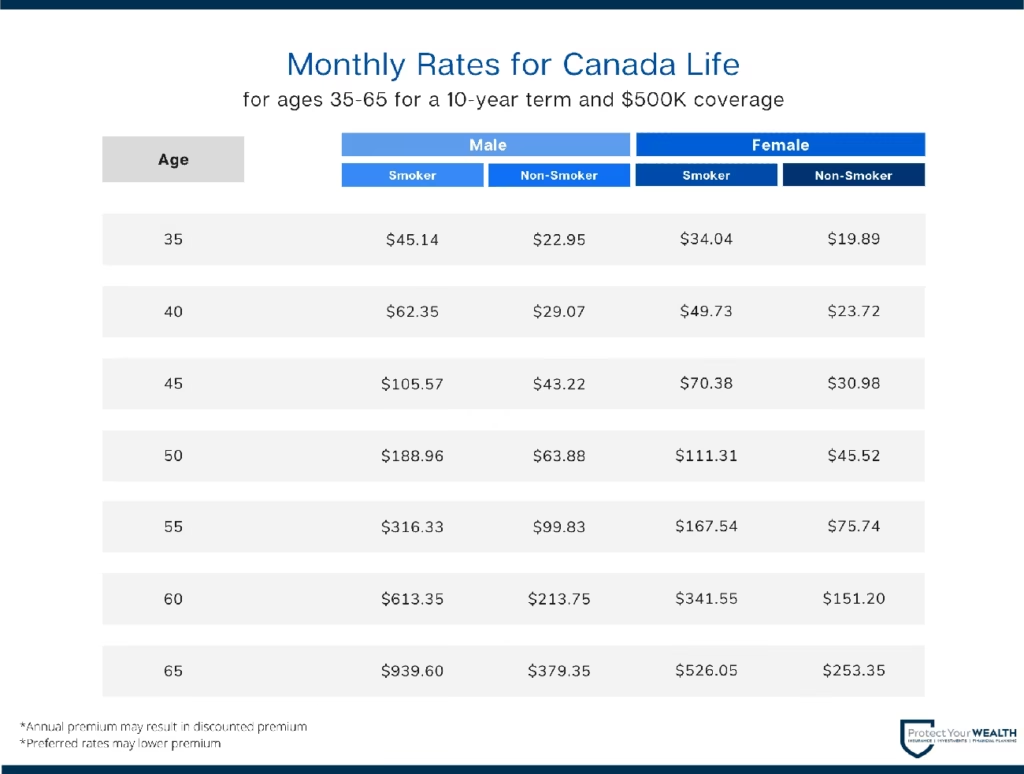

Review Your Policy Annually to Catch Overlooked Savings

Image Source: Protect Your Wealth

Regular insurance policy reviews are one of the least used ways to find hidden savings. Most Canadians put their insurance on autopilot. They forget that life changes—and so do their coverage needs and discount eligibility.

Why annual reviews matter

A yearly insurance audit will give you the right coverage at the right price and protect you from gaps that can get pricey. Your coverage might lapse without these reviews, leading to legal and financial risks. These checkups help you spot areas where you're paying too much or carrying coverage that doesn't fit your life anymore.

About 84% of people with outdated policies find coverage gaps only when they file claims—usually when it's too late. A full picture of your policy ended up giving you the chance to tweak your coverage or find new discounts that you might qualify for now.

What to look for in your policy

Start by checking your declaration page that shows a summary of your current coverage. Look at these key elements:

- Coverages and exclusions (understanding what is and isn't protected)

- Premium costs and potential discount eligibility

- Deductible amounts (could raising them lower your premium?)

- Changes in property value that require coverage adjustments

- New or removed assets that affect your insurance needs

Keep a close eye on exclusions that spell out losses or property types your policy doesn't cover. These details can affect your protection level by a lot.

How to compare without switching providers

Before shopping around, talk to your current provider about ways to optimize your coverage. Ask them: "Is my premium as low as I can expect it to be?" and "Are there additional discounts available?".

Insurance companies offer mitigation discounts when you take steps to reduce potential losses. Comparing options doesn't mean you have to switch—you might use that information to get better rates with your current provider.

Reach out to us for a bundling quote review to ensure you're getting all possible discounts from your current provider. This service helps you find overlooked savings where your existing relationship can save you money.

Side-by-Side Comparison of 7 Insurance Savings StrategiesComparison Table

| Savings Method | Potential Savings Range | Key Requirements | Implementation Timeline | Notable Benefits | Considerations |

|---|---|---|---|---|---|

| Telematics Programs | 5-30% (original 5-10% for enrollment) | You must allow driving behavior monitoring | Immediate enrollment discount; Full benefits after 6 months | Makes driving habits better; Helps track stolen vehicles | Some programs raise rates for poor driving |

| Loyalty Rewards | 5-10% (grows with tenure) | Continuous coverage with the same provider | Usually starts after 3 years | Includes claim forgiveness, Cash-back options | You need continuous coverage |

| Policy Updates | Not specified | Major life changes (marriage, renovations, etc.) | Within 30-60 days of changes | Will give proper coverage; Prevents claim denials | You need to stay in touch with the insurer |

| Group/Membership Discounts | Up to 33% | Membership in qualifying organizations | Immediately upon verification | No extra cost to access; Multiple eligible groups | You can use only one group discount per policy |

| Home Safety Improvements | 5-25% | Installation of qualifying safety features | Upon verification of improvements | Protection and savings together | Needs upfront investment; Professional installation needed |

| Avoiding Small Claims | 10-30% (claims-free discount) | Keep a claims-free record | Builds over time | Stops premium increases; Long-term savings | You need emergency funds for small repairs |

| Annual Policy Review | Varies | Regular policy check | Annual | Spots coverage gaps; Shows new discount options | You must review policy details regularly |

Conclusion

You might think cutting insurance costs with your current provider is tough. But our strategies show there are many ways to save money. Most Canadians think switching companies is their only option to get better rates.

Telematics programs give you instant discounts when you sign up. These programs also help you save more money based on how you drive, not just averages. On top of that, loyalty programs reward you for staying with your provider. Your discount can grow up to 10% after ten years.

Major life changes give you natural chances to update your policy and cut costs. You could also qualify for group discounts up to 33% through professional associations, alumni groups, or employer programs.

Making your home safer helps in two ways - it protects your family better and lowers your premiums. Smart choices about when to file claims help you keep your claims-free status and save thousands over time. Regular policy reviews help you get all the discounts you deserve.

Using all seven strategies at once might seem like a lot. But even one or two can help you save good money. The comparison table helps you pick the best methods for your needs.

Note that you don't need to switch providers or cut your coverage to save on insurance. These savings are already there with your current provider. Simple changes to how you handle your coverage can save you money while keeping the protection you need.

Ready to start saving? Pick the strategy that's easiest for you and call your provider today. The money you save might surprise you - no provider switch needed.

Key Takeaways

Discover seven proven strategies to reduce your insurance premiums while maintaining your current provider relationship and coverage quality.

• Enroll in telematics programs for instant 5-10% discounts - Monitor your driving habits through apps or devices to unlock usage-based savings up to 30%

• Leverage loyalty rewards that increase over time - Stay with your provider for 3+ years to earn escalating discounts reaching 10% after a decade

• Update policies after major life changes immediately - Marriage, home renovations, or new assets can trigger discounts and prevent coverage gaps

• Tap into group discounts through memberships - Professional associations, alumni status, or employer connections can save up to 33% on premiums

• Install safety features for dual benefits - Home security systems, water leak detectors, and roof upgrades reduce risk while lowering costs 5-25%

• Avoid filing small claims to preserve discounts - Claims-free records maintain 10-30% discounts; small repairs often cost less than premium increases

These strategies work independently or together, allowing you to customize your approach based on your situation. The key is proactive communication with your current insurer about available discounts and maintaining good risk management practices that insurers reward with lower premiums.