The snowball method helped me clear $40,000 of consumer debt in just 18 months! Want to know what it is?

The debt snowball method might surprise you - it doesn't target high-interest debts first. This powerful debt reduction strategy helps you pay off debts from smallest to largest, whatever the interest rate. The method works because it creates psychological wins when you eliminate debts quickly, keeping you motivated throughout your debt-free experience.

Research shows people using the snowball approach pay off their whole debt load more often than those trying other methods. Real results back this up - the average household in Financial Peace University clears $5,300 in just 90 days with this method.

Quick wins from eliminating smaller debts boost your confidence and motivation to tackle bigger balances. The momentum builds after you clear that first debt, pushing you toward even greater achievements.

Let me show you exactly how the snowball debt payoff method works, why it clicks psychologically, and the step-by-step process that will revolutionize your financial future.

What is the Snowball Method of Paying Off Debt?

The debt snowball method offers a unique way to eliminate debt. Financial expert Dave Ramsey made this method popular. This technique helps you pay off your smallest balances first instead of focusing on high-interest debts. Your momentum builds up as you move toward financial freedom.

Picture a snowball rolling down a hill. It picks up more snow and gets bigger as it moves. This method works just like that snowball. You'll have more money to pay off bigger debts as each small balance disappears.

Here's the quickest way to use the debt snowball method:

- List all your debts from smallest to largest balance (disregarding interest rates)

- Make minimum payments on all but one of these debts - your smallest one

- Put all extra money toward your smallest debt

- Roll the payment amount into your next smallest debt once you clear the smallest one

- Keep going until you've cleared all debts

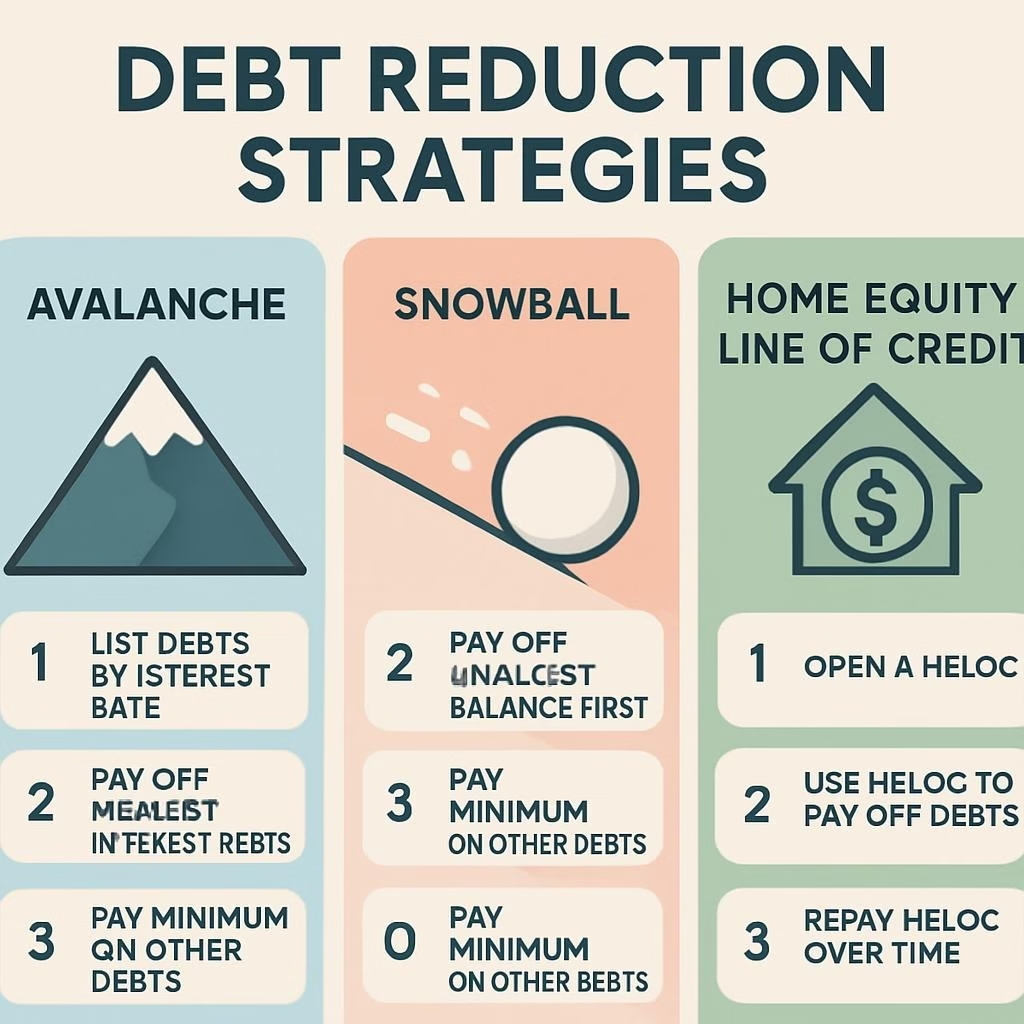

The debt snowball method differs from others like the debt avalanche method because of its psychological edge. You might save more money by targeting high-interest debts first. However, the quick wins from paying off smaller debts keep you motivated.

Research shows debt management depends on behavior 80% of the time and mathematical knowledge only 20%. Your brain gets a boost of satisfaction from clearing smaller debts quickly. This satisfaction drives you to keep going.

A 2012 Northwestern University study backs this up. People who tackle small balances first clear their total debt more often than those focusing on high-interest balances. Harvard Business Review published similar findings - your motivation grows more from clearing a balance completely than from the size of your payment.

The debt snowball method might cost more in interest than other approaches. Yet its psychological benefits usually make up for this difference. It helps you stay focused throughout your trip to becoming debt-free.

Why the Snowball Method Works Psychologically

The debt snowball method's psychological effects go beyond simple money management. Personal finance is fundamentally 80% behavior and only 20% head knowledge. This explains why we often prioritize psychological motivation over mathematical optimization when paying off debt.

Research shows this approach works because paying smaller debts first gives you quick wins. A study from the Journal of Consumer Research backs this up - the snowball method succeeds because it makes you feel good about your progress. Your brain releases dopamine when you knock out those smaller debts, which rewards you for moving forward.

Each debt you clear acts as positive reinforcement. People often do a mental "happy dance" after paying off their first small credit card. They think, "That was awesome! Let's do it again!". This boost builds momentum to tackle bigger debts.

Wiping out a debt completely gives you a powerful mental edge. Instead of making small payments on multiple accounts, you get to cross one obligation off your list for good. These real results keep you involved throughout your debt-free trip.

The snowball method turns your mountain of debt into smaller, achievable goals. Breaking down large amounts makes everything feel more doable. You can track your progress in steps or use charts - these smaller targets energize you and make the whole thing seem possible.

The method's simplicity offers another mental benefit. You always know which debt to target next. This clarity helps reduce the mental strain that comes with financial stress. Research shows that ongoing debt disrupts your thinking and decision-making abilities. This makes the snowball method's straightforward approach even more valuable.

This psychological edge works even when people know it's not the best math. Studies prove that focusing on clearing smaller balances leads to more success in eliminating total debt compared to targeting high-interest balances first.

How to Use the Debt Snowball Method Step-by-Step

Are you ready to begin a journey toward becoming debt-free? The debt snowball method needs organization, steadfast dedication, and a clear plan of action. Let me show you the quickest way to set up and execute this powerful strategy:

Make a complete list of every debt you owe, including credit cards, medical bills, student loans, car payments, and personal loans. Add both the total balance and minimum monthly payment for each one.

Put these debts in order from smallest to largest balance - completely ignore interest rates. This unusual approach gives you psychological wins that matter more than mathematical optimization.

Make minimum payments on all your debts to avoid late fees and penalties. This helps maintain your credit score while you work through the snowball process.

Build momentum by putting any extra money in your budget toward your smallest debt. You might need to find additional income through side hustles, as many successful debt snowballers have done.

After you eliminate your smallest debt, take the money you were putting toward it (minimum payment plus extra) and add it to payments for your next-smallest debt. To name just one example, a $70 monthly payment on your smallest debt now gets added to your next debt's minimum payment.

Your payment power grows substantially as you knock out each balance, like a snowball rolling downhill. People report feeling much less stressed after they use this method because they can see real progress and have a clear plan.

Please bookmark this page to refer to these steps whenever you need motivation during your debt-free journey, and contact us to receive a comprehensive financial makeover tailored to your specific situation.

The debt snowball method has revolutionized ordinary people's financial situations - from Moon, who crushed her debt with this exact process, to Sarah, who eliminated $27,867 in business debt. Their soaring wins show that financial freedom isn't just possible - you can achieve it by consistently applying these snowball principles.

Conclusion

The debt snowball method is a powerful way to eliminate debt that focuses on quick wins rather than mathematical optimization. My personal experience and research show how paying off smaller debts first creates momentum toward financial freedom. The early victories give you those dopamine hits that keep you motivated throughout your debt-free trip.

This method works because it understands that personal finance is about behavior. Financial experts might suggest tackling high-interest debts first. Yet studies show people who use the snowball method are more likely to clear all their debt. The mental boost you get often matters more than the interest savings from other approaches.

You can start your debt-free trip with simple steps. List your debts from smallest to largest. Make minimum payments on all but your smallest debt. Put any extra money toward that smallest balance. Once that first debt is gone, roll those payments into the next one. This creates a snowball effect that gets stronger over time.

Success stories prove this works - from my own $40,000 debt payoff to others who changed their financial lives. Save this page to review these steps when you need motivation. Reach out to us to get a complete financial makeover that fits your needs!

The snowball method gives you more than freedom from debt. You get less stress, more confidence with money, and a system that matches how our brains respond to progress. Your debt-free future starts now, one small win at a time.

Key Takeaways

The debt snowball method prioritizes psychology over mathematics, helping you build unstoppable momentum toward financial freedom through strategic small wins.

• Start small, win big: List debts from smallest to largest balance and attack the smallest first, regardless of interest rates, to create powerful psychological momentum.

• Psychology beats math: Personal finance is 80% behavior and 20% knowledge - quick victories from eliminating smaller debts fuel motivation better than focusing on high-interest balances.

• Roll payments forward: After paying off each debt, immediately add that payment amount to your next smallest debt, creating an increasingly powerful "snowball" effect.

• Proven results: Studies show people using the snowball method are more likely to eliminate their entire debt load compared to other strategies, with average participants paying off $5,300 in the first 90 days.

The snowball method transforms overwhelming debt into achievable milestones, providing clarity and reducing decision fatigue while building the behavioral habits necessary for long-term financial success.

FAQs

Q1. How does the debt snowball method work? The debt snowball method involves listing your debts from smallest to largest, making minimum payments on all debts except the smallest one, and putting any extra money towards paying off that smallest debt. Once it's paid off, you roll that payment into the next smallest debt, creating a snowball effect.

Q2. Why is the debt snowball method effective psychologically? The debt snowball method is psychologically effective because it provides quick wins by paying off smaller debts first. These early victories release dopamine in the brain, creating a sense of accomplishment and motivation to continue tackling larger debts.

Q3. Is the debt snowball method better than focusing on high-interest debts? While mathematically it might make sense to focus on high-interest debts first, studies show that people using the snowball method are more likely to pay off their entire debt load. This is because personal finance is about 80% behavior and 20% knowledge, making the psychological benefits of the snowball method often outweigh potential interest savings.

Q4. How long does it typically take to see results with the debt snowball method? Results can vary depending on individual circumstances, but many people see significant progress within the first few months. For example, the average household taking Financial Peace University pays off $5,300 in the first 90 days using this method.

Q5. Can I modify the debt snowball method to fit my specific financial situation? Yes, you can adapt the debt snowball method to your needs. While the core principle is to pay off the smallest debt first, you might choose to prioritize a high-interest debt if it's causing significant financial strain. The key is to maintain the momentum and motivation that comes from seeing debts disappear one by one.